BLOK-Chain Monthly April 2024

First Quarter 2024 Trends are Strong

BLOK rallied 8.35% in March, bringing the YTD and first quarter NAV return to 21.72% (see performance). The Fund was unusually active relative to our historic patterns. In an effort to maintain the Fund’s high correlation with Bitcoin, while also remaining focused on the core mandate (investing in public companies that are dedicated to building out the infrastructure around blockchain and “Public Digital Property”), we steadily trimmed stocks like MicroStrategy, Coinbase, and Cleanspark, which appeared ahead of themselves. This activity was relatively systematic in nature as it followed established risk controls and our discipline to remain diversified in our approach.

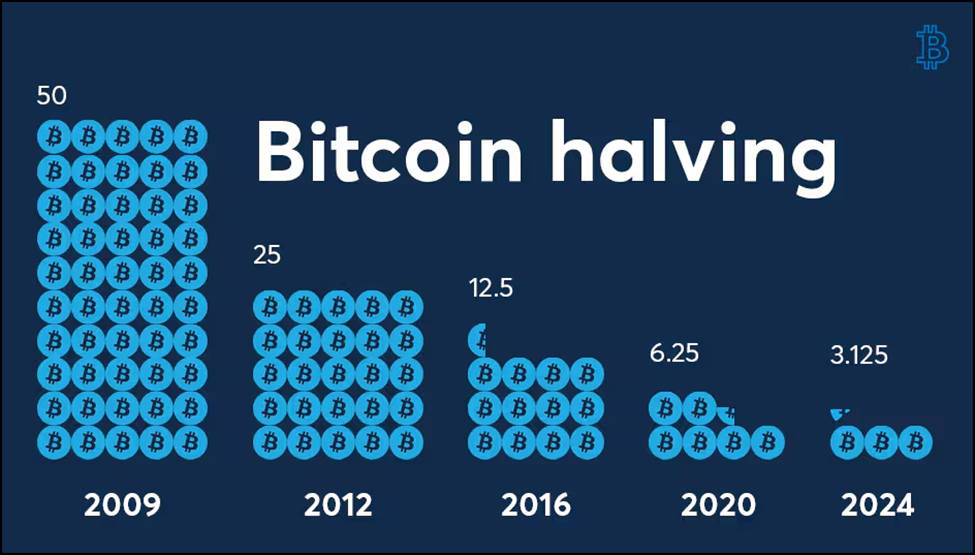

Bitcoin Halving Historic Outcomes

The Bitcoin halving is scheduled to take place on or around April 19th and it is sure to inspire and surprise! If Bitcoin price follows past trends and rises to new highs, miners will distinguish themselves through the efficiency with which their management teams have scaled their business, but it will certainly not be without drama. This is why we have chosen to diversify across strategic approaches to business, management teams, and geography. In fact, we fully expect to be surprised both on the upside and the downside by the many different variables to this business. However, while the media may make a big deal about the much-anticipated “post-halving rally,” the smart management teams are already looking out to 2028.

Bitcoin Mined Per Block Over Time

Source: CME group, Bitcoin Halving 2024 – This Time It's Different', April 2024.

Historically, each halving has brought extraordinary rallies in the months preceding and following the change in supply. Like a small-cap company that expands its market capitalization, we expect the liquidity in the asset class to reduce some of the volatility as institutions tend to absorb the dips.

- Notably, in the 365 calendar days after the November 28, 2012 halving, when the reward was cut from 50 BTC to 25 BTC, bitcoin prices rose 8,447%.

- In the year following the July 9, 2016, halving, bitcoin prices rose a more modest but still impressive 283%, and block reward was reduced to 12.5 BTC.

- In the 12 months after the May 11, 2020, halving, where reward was cut to 6.25 BTC per block, bitcoin price jumped 527%.

Obviously, as the warning goes, past performance is not indicative of future outcomes, so please do not ask us to come up with a forecast on price. Bottom line, before we talk $100,000, we must clear $75,000, and who knows whether we’ll go lower before we go higher. However, the math looks very compelling. As a result of the halving, the bitcoin network in aggregate will only produce $27 million in bitcoin a day after April 19th (the basic math is $60,000 price times 450 bitcoin). This ends up providing much of the supply beyond regular trading activity from wallets and traders.

Please do not confuse us as maximalists in the way of bitcoin. As portfolio managers, we believe there are times to overweight the asset class and times to be more modest. However...

*BPs: A basis point (BP) is a unit that is equal to 1/100th of 1%.

**Schedule K-1 is a federal tax document used to report the income, losses, and dividends of a business’ or financial entity’s partners or an S corporation’s shareholders. This information does not constitute, and should not be considered a substitute for, legal or tax advice.

1 Decentralized finance, or DeFi, uses emerging technology to remove third parties and centralized institutions from financial transactions https://www.investopedia.com/decentralized-finance-defi-5113835#toc-what-is-decentralized-finance-defi

2 Figures included the Core Scientific Notes and rights (CORZVR) which as of March 31 represented 2.02% out of the 20.52% and which began trading January 24, 2024.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end please visit BLOKETF.com.

Click HERE for BLOK’s top 10 holdings.

Click HERE for BLOK’s prospectus.

The Fund is subject to management risk because it is actively managed. Narrowly focused investments typically exhibit higher volatility. A portfolio concentrated in a single industry, such as companies actively engaged in blockchain technology, makes it vulnerable to factors affecting the companies. The Fund may face more risks than if it were diversified broadly over numerous industries or sectors. Blockchain technology may never develop optimized transactional processes that lead to realized economic returns for any company in which the Fund invests.

The Fund invests at least 80% of the Fund’s net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies. Such investments may be subject to the following risks: the technology is new and many of its uses may be untested; theft, loss or destruction; competing platforms and technologies; cybersecurity incidents; developmental risk; lack of liquid markets; possible manipulation of blockchain-based assets; lack of regulation; third party product defects or vulnerabilities; reliance on the Internet; and line of business risk. The investable universe may include companies that partner with or invest in other companies that are engaged in transformational data sharing or companies that participate in blockchain industry consortiums. The Fund will invest in the securities of foreign companies. Securities issued by foreign companies present risks beyond those of securities of U.S. issuers.

The Fund may have exposure to cryptocurrencies, such as bitcoin, indirectly through investment funds. The Fund does not invest directly in bitcoin. Holding a privately offered investment vehicle in its portfolio may cause the Fund to trade at a premium or discount to NAV. Many significant aspects of the U.S. federal income tax treatment of investments in cryptocurrencies are uncertain and such investments, even indirectly, may produce non-qualifying income for purposes of the favorable U.S. federal income tax treatment generally accorded to regulated investment companies.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.