BLOK-Chain Monthly Commentary January 2023

THE MANDATE

The Amplify Transformational Data Sharing ETF (BLOK) is an actively managed fund, seeking to identify the leading companies focused on the transformation and development of the blockchain and cryptocurrency markets. The managers focus on how companies can capture the growth, innovation, and disruption of the blockchain paradigm shift. The evolution of the internet has changed how people communicate. We believe growth companies that embrace blockchain evolution will capture secular growth trends that are accelerating and disrupting core processes in business. We think this is an important secular trend, as Gartner forecasts business value generated by the blockchain could be $176 billion by 2025, and $3.1 trillion by 2030.

DECEMBER MONTHLY & YEAR END HIGHLIGHTS:

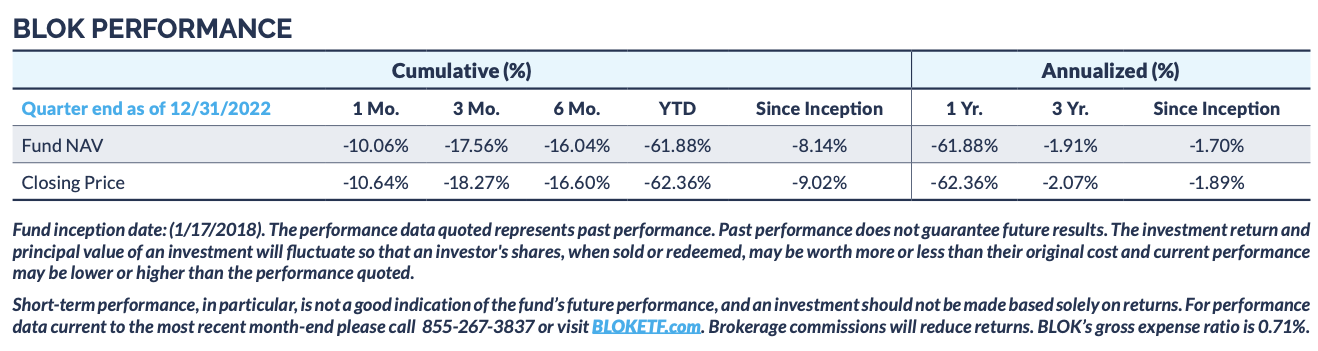

The Fund was down 61.88% in 2022, which includes a December decline of 10.06%. Such results will test the resolve of some investors, but we remain confident in the future transformational change that we see coming from broad adoption. Put simply, our long-term views on the benefits of blockchain technology in 2023 and beyond have not changed, despite the negative sentiment around crypto. Our message: don’t judge progress simply by price action, even when it hurts.

Looking back on 2022, we would argue the following:

■ The 2022 market bubble-burst, caused by liquidity drying up, clobbered all risk assets, especially those that were at an early stage of their evolution. Unfortunately, this meant that investors in bitcoin miners and crypto trading platforms suffered losses in two stages. First, high-growth multiples contracting while earnings estimates continued to rapidly decline. In stage two, earnings expectations transformed to losses and the businesses contracted.

Deciding to own less of something that is declining in order to add value to a portfolio is not always a clear decision for outside investors, but in many cases, this is the action that our process dictated to us in in 2022. Turning to 2023, we will look to play offense when appropriate as things do seem to be oversold (see 2023 outlook below). Most importantly, we think counter-cyclical investors can benefit from this trend, as the resizing of these businesses could create a spring board opportunity when conditions rebound and lead operating structures to surprise upsides.

■ The fraud perpetuated by Sam Bankman-Fried (SBF) and the overwhelming leverage in the system will push forward the demands for industry led immutable blockchain technology and the realities of the need for a “trustless society” when it comes to data and transference of information. Reportedly, according to a Houbi reports about 2023 and token terminal, leverage against lending protocols is down to $4 billion from $25 billion and mostly flattened out (See Appendix Chart 1). Math and cryptology, as validated by either Proof of Work (PoW) or Proof of Stake (PoS), will not solve for greed and bad human behavior. Yet, investors need to note that we believe decentralized finance’s culture remains pure in our opinion, and its development is mostly continuing at an aggressive pace.

■ Recent commitments from substantial firms like Blackrock, Google, Bank of New York Mellon and of course Fidelity have been largely ignored by the markets. Regardless, by offering easier access for both institutions and retail investors, these announcements provide evidence of true foundational support to rebuild on past momentum when the dark winter clouds pass.

■ On crypto: while crypto trading fell off a cliff, crypto wallet growth reached an all time high. Furthermore, despite questions around the profitability of bitcoin mining at current levels, the security of the system (as measured by the processing power on the platform) remains near an all-time high. Put differently, the media has lost the fact that the hash rate, operating the cryptology that confirms how the blockchain ledgers are interconnected and immutable, has never been more secure.

■ 2022 was the year that mortgages were traded on blockchain, art was reinvented in terms of both value and style, and early stage blockchains were established to address supply chain concerns. In addition, major strides were taken to provide foundational infrastructure that can enable the transference of property or value efficiently. This is not to say that 2022 was not without failure. Much can be said about the loss of $2 trillion in whatever form you call it (fiat, dollars, bitcoin or doge). However, much more was lost in equity markets. Apple stock was also down $1 trillion from its highs in 2022, and some even point out the ~$5 to $7 trillion loss in the large-cap technology sector, which employs millions of workers (MSFT, AMZN, NVDA, META, AVGO, BABA,TCEHY, TSM, TSLA). The fact is that innovation does not come without risk. Therefore, when investors think aboutthe rewards earned in these industries over the past 5-10 years, they will be patient. Successful disruption across industries is inevitable, but the journey is not always neat. Our point, we do not believe that the years 2022 (or 2021 for that matter) 2022 will be looked back in future years the right metrics to measure value and or future disruption

Bottom line, much of 2022 reflects price momentum from deleveraging an illiquid, volatile asset class, rather than a failure around the technology.

OUTLOOK AND METRICS TO WATCH IN 2023:

■ Back to Basics: Getting back to basics will be the glue that drives confidence and performance in 2023. We believe developments around the utility value of bitcoin and Ethereum, the large caps in the asset class, will provide the initial formation of confidence. But don't be surprised if trading flat, after bottoming, is the new "Bored Ape." Most market turnarounds start with a period of boredom and low interest as selling pressure becomes exhausted and negative headlines subside. We are in the camp that opportunistic creative disruption comes to in times of calm.

■ Lightning Network: Expanding blockchain technology application related to the Lightning Network (LN) will come familiar sources like MicroStrategy and others. For reference, Michael Saylor released the news on his podcast via Twitter on Dec. 28, 2022. The emphasis of the announcement was to create an application for cyber security/BOTs and marketing for websites. Rather than speculate the outcome from this announcement, we will be monitoring Mr. Saylor's Twitter posts closely, where he is known to be transparent with his views.

■ Regulation and a trading infrastructure: In 2023, e envision that companies like Coinbase (COIN), Galaxy Digital (GLXY.CN/BRPHF) and Robinhood Markets (HOOD) will evolve beyond having trading platforms as the center of their business model. Most everyone agrees that further regulation is needed and coming, but what forms it will take is the question. We highlight these companies because we know they are at the center of the infrastructure and because they are known for seeking guidance from the regulators. A similar comment could be made about CME Group (CME) and non-traditional platforms like BLOCK (SQ) and Paypal (PYPL). When Gensler says, “my office is always open,” these are the companies whose CEOs are walking through the front door and saying, “please help us provide a framework!”

■ As early adopters they are knowledgeable, well capitalized, and want to find ways of utilizing the inevitable transformation of industries. Doing the right thing is the common goal.

■ Fortune 500 companies like Visa and Mastercard who have been active investors in blockchain will continue to lead as consolidators of blockchain technology and infrastructure companies. The truth is that companies like Visa and Mastercard are leading the charge because they have a need to cannibalize and re-invent their business. Similarly, firms like Google, IBM and Accenture see the value of disintermediation of industries and now have the opportunity to own larger chunks of equity than when venture capital was so easily accessible.

■ Proof of Adoption will come in the form of:

- According to Crypto.com, the number of global wallets increased in 2022, from 306 million on January 1 to 402 million on December 1. This number could grow to about 600-800 million by the end of 2023. Granted, people have multiple wallets, and with a name like Crypto.com, readers should assume a bias. Regardless, this kind of data is factual in nature by virtue of the transparency of the blockchain (See Appendix Chart 2 – Wallet Growth).

- The number of “Smart Contracts” on the Ethereum network as of September 30, 2022, was 117,922, or an aggregate of 36% of the cumulative count, according to Alchemy. This proves two things according to Alchemy: (1) Since Ethereum was down 50% year-over-year, the price of Ethereum action has little to do with the value proposition that the contracts are solving for. (2) 323,749 smart contracts since 2015 have been deployed. This means that 36% of what was deployed took place in the 9 months ending September 30, 2022, before the Ethereum upgrade. This number is also a 50% increase over the record year of 2021. Given the objective of “Merge/PoS is to accelerate adoption through technical improvements we would expect adoption to accelerate. (See Chart 4: 50% Increase in Verified Smart Contracts)

- Stablecoins are the target in 2023! In 2022, Stablecoin volume hit a record of $7.4 trillion worth of transactions, up from $6 trillion in 2021 and remarkably up 6x from $1 trillion in 2020. As a result, this metric needs to be monitored closely since it reflects inflows and outflows of trading in the space. Ironically, as key metrics of liquidity in the cryptosphere, it is ironic that the volume is so high while the trading is down some 90%. Stablecoins represent about 18% of the value of digital assets, according to a report by Samuel Haig at Defiant https://thedefiant.io/stablecoin-volume-hits-record-high-of-7-4t-in-2022. A rebounding of interest in trading would be clearly reflected in a spike of volumes as digital resources are spent.

The Transactional category is the Fund’s largest category, accounting for 27.44% of the Fund. This category used to be combined with what we now call Applications. We segmented the two categories because the business models are different and, as such, so are the risk profiles. Platform companies include banks like Signature Bank (SBNY), New York Community Bancorp (NYCB) Customers Bancorp Inc (CUBI), Silvergate Capiital (SI) and New York Community Bancorp NYCB. As mentioned above, they also include companies that involve transactional business like Coinbase Global (COIN), Robinhood (HOOD), MOGO, Inc (MOGO) and Big Digital Assets (BBKCF). Historically, as a merchant bank, we have included Galaxy Digital (GLXY CN/BRPHF) in the venture category, but after they took a $70M loss on FTX, it could be argued that this investment crosses multiple categories.

With literally trillions at stake, we would expect regulations to continue making headlines. Ultimately, we expect that a coordinated approach to crafting a process will be achieved in the U.S. simply because, from a competitive standpoint, politicians, regulators, and the people implementing the technology need the framework to meet the needs of the people they report to. No one wants to see the U.S. fall behind on the potential underlying innovative benefits that blockchain provides. As a result, we were not surprised by the joint statement made by federal regulators, and hope that the cautious tone remains measured, actionable, and practical. Unfortunately, regulation is a precarious process, so one step forward sometimes may lead to two steps backwards.

In December, we made some modifications to the portfolio by trimming positions in IBM, Accenture and SBI Holdings, and increasing positions in RIOT Blockchain, Coinbase Global and Galaxy Digital. We have been active with our position size in Galaxy Digital over the years since we initially made the investment in September 2018. The company is unusual in its reach into the crypto-ecosystem, with 5 core business: Venture/Merchant Banking, Asset Management, Trading, Mining, and Advisory, and almost most importantly... $1 billion in cash as a war chest. After visiting with management twice and seeing the news about how the company was positioned to capitalize on the distressed environment by acquiring the mining facility Helios from Argo and bulking up on their institutional trading business with the acquisition of GK8, we felt the risk-reward justified increasing the size of the position back to a core holding, especially given the combination of cash and IP. Core holdings are those positions we have high conviction with. In December, we also increased our exposure to MicroStrategy with incremental purchase of 6 1/8 Senior Bonds. The firm currently owns 135,000 bitcoin and the bonds mature in 2028, but if bitcoin rips in 2024, they could be called at 103. Conversely, as senior bonds we believe we have sufficient collateral and can be patient if bitcoin continues to have digestion issues.

EDUCATION

For those who just want to get educated about blockchain regulations, here are some links:

■ What is Blockchain according to McKinsey https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is- blockchain?cid=soc-web

■ For the visionary or brainiacs – remember the Blockchain is about programing. Those who want to be challenged please listen to Scott Melker’s Wolf Of All Wall Street Podcast 1.7 Billion People Are Unbanked Crypto Fixed This Staci Warden, Algorand https://www.youtube.com/watch?v=gWitvpx0XRs

■ Satoshi Nakamoto Original Bitcoin White paper: Bitcoin: A Peer-to-Peer Electronic Cash System https://bitcoin.org/bitcoin.pdf

SUMMARY

Despite the Fund being down 61.88% in 2022, we see evidence that blockchain technology and the infrastructure behind digital assets made broad progress last year. Nevertheless, weak human behavior which included fraud and overleverage caused a crisis of confidence, measured by price - ironic given that the blockchain is designed to provide a means for a trustless society through the purity of math. We have no crystal ball but will be monitoring certain metrics in 2023 which include (1) a period of boredom we refer to as the new Bored Ape, (2) more developmental progress on the Lighting Network on Bitcoin and an acceleration of growth in smart contracts, (3) progress on the regulatory front, and (4) further blockchain investment from Fortune 500 companies.

In December we reduced certain top holdings including IBM, Accenture and SBI Holdings, and increased our positions in RIOT Blockchain, Coinbase Global and Galaxy Digital Holdings. There are many challenges in trying to call a bottom in a market, and conditions are certainly oversold. Arguably, these are great times for investors looking to catch counter cyclical opportunities in the long term positive trends around the blockchain and digital asset markets. Companies in our universe have already reduced headcounts significantly in the Transactional category which we highlight in this report. This potentially sets up for a springboard opportunity for investors looking to capitalize on the inevitable change across industries.

Disclosure

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by calling 855-267-3837, or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Click HERE for BLOK’s top 10 holdings.

Click HERE for BLOK’s prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. The Fund’s return may not match or achieve a high degree of correlation with the return of the underlying index.

The Fund is subject to management risk because it is actively managed. Narrowly focused investments typically exhibit higher volatility. A portfolio concentrated in a single industry, such as companies actively engaged in blockchain technology, makes it vulnerable to factors affecting the companies. The Fund may face more risks than if it were diversified broadly over numerous industries or sectors. Blockchain technology may never develop optimized transactional processes that lead to realized economic returns for any company in which the Fund invests.

The Fund invests at least 80% of the Fund’s net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies. Such investments may be subject to the following risks: the technology is new and many of its uses may be untested; theft, loss or destruction; competing platforms and technologies; cybersecurity incidents; developmental risk; lack of liquid markets; possible manipulation of blockchain-based assets; lack of regulation; third party product defects or vulnerabilities; reliance on the Internet; and line of business risk. The investable universe may include companies that partner with or invest in other companies that are engaged in transformational data sharing or companies that participate in blockchain industry consortiums. The Fund will invest in the securities of foreign companies. Securities issued by foreign companies present risks beyond those of securities of U.S. issuers.

The Fund may have exposure to cryptocurrencies such as bitcoin indirectly through investment funds, including through an investment in the Bitcoin Investment Trust ("GBTC"), a privately offered, open-end investment vehicle. Even when held indirectly, investment vehicles like GBTC may be affected by the high volatility associated with cryptocurrency exposure. Holding privately offered investment vehicle in its portfolio may cause the Fund to trade at a premium or discount to NAV. Many significant aspects of the U.S. federal income tax treatment of investments in cryptocurrencies are uncertain and such investments, even indirectly, may produce non-qualifying in- come for purposes of the favorable U.S. federal income tax treatment generally accorded to regulated investment companies.

Amplify Investments LLC is the Investment Adviser to the Fund, and Toroso Investments, LLC serves as the Investment Sub-Adviser.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.