EMFQ 2nd Quarter Market Commentary

MARKET COMMENTARY

Emerging market equities delivered positive returns for the third consecutive quarter with the MSCI Emerging Markets Index* returning 0.90% for Q2. Global and domestic markets delivered stronger returns with the MSCI All Country World Index* delivering 2.95% and S&P 500 rising 8.74%.

Emerging markets continued in positive territory amid a less-aggressive Federal Reserve, exhibiting little fallout following the banking crisis of the first quarter. Decelerating inflation and slowing growth eased pressure on emerging market central banks to hike rates.

Financial technology (fintech) stocks benefited from the resurgence in emerging markets in general as well as the continuing adoption of digital finance solutions, mobile payment platforms and online banking services. In the U.S., the tech-heavy Nasdaq climbed 13.05% for the period. EMFQ, which provides exposure to emerging and frontier market companies that derive at least 50% of their revenue from (fintech), delivered positive returns for the period.

EMFQ's top contributors to perform for the period included XP Inc. (97.64%), NU Holdings Ltd. (65.76%) and Network International Holdings (61.23%). Click HERE for EMFQ's top 10 holdings.

Brazilian-based XP Inc., a technology platform and provider of low-fee financial products, turned around in the period, reporting it beat estimates for first-quarter revenue helped by growth in client assets and active customers. The company reported its clients remained mostly undeterred by a looming recession and market turmoil triggered by the U.S banking crisis.

Also in Brazil, online bank, NU Holdings, delivered strong returns for the ETF on early signs of success in Brazilian payroll lending and Mexican customer acquisition, as well as improving investor sentiment over the Brazilian macroeconomic and rates outlook.

Network International Holdings saw its shares rise strongly early in the period as bidding wars started for the company, the largest payment processing firm across the Middle East and Africa. Analysts reported that the company was set to benefit from changes in payments and financial services infrastructure in the Middle East and Africa.

Detractors from EMFQ’s performance for the period were Sea Limited (-32.94%), DLocal Ltd (-24.75%) and Futu Holdings (-23.36%).

Sea Limited, an Asian company with business segments in video games, e-commerce, and financial technology, fell during the period after hitting an all-time high in Q1. In 2Q, the company was rumored to be winding down its investment arm amid rising interest rates and less M&A activity. Despite losses earlier in the period, analysts report the company was near a breakeven point toward the end of the period.

Shares of Uruguayan fintech dLocal saw its shares fall after an Argentinian news outlet published an article reporting the government was investigating it for possible fraud.

Digital brokerage and wealth management platform Futu Holdings also saw shares fall sharply in Q2 after delivering strong returns in Q1. During the period, the company announced it planned to remove its apps from online stores in China that allow their customers to trade stocks overseas. The move was made amid Chinese scrutiny of foreign business regulation.

A return to growth-style technology stocks in the U.S. bodes well for the overall environment for emerging markets fintech companies. Emerging markets fundamentals remain appealing with a superior growth outlook and an inflation decline. These factors combined contribute to our optimistic outlook for the accelerated pace of fintech development.

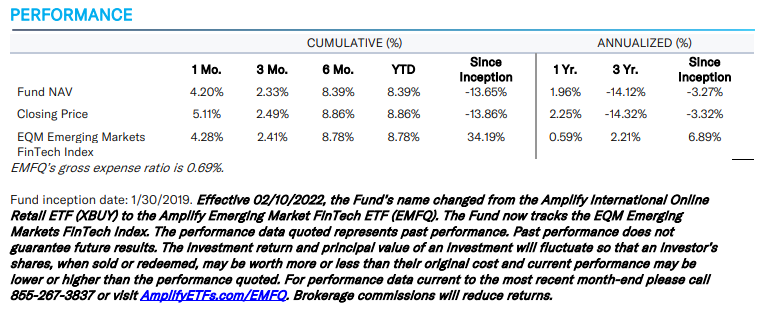

PERFORMANCE

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Funds’ statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. The fund is new with limited

operating history. The Fund is not actively managed. The Fund invests in securities included in its Index regardless of their investment merit.

Narrowly focused investments typically exhibit higher volatility. A portfolio concentrated in a single industry, such as the fintech industry, makes it vulnerable to factors affecting the industry. The Fund may face more risks than if it were diversified broadly over numerous industries or sectors. Technology and internet companies are subject to rapidly changing technologies; short product life cycles; fierce competition; aggressive pricing and reduced profit margins; the loss of patent, copyright and trademark protections; cyclical market patterns; evolving industry standards; and frequent new product introductions.

The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Investments in smaller companies tend to have limited liquidity and greater price volatility than large-capitalization companies.

Investments in emerging and frontier markets involve greater volatility and political, economic, and currency risks and differences in accounting methods.

The Fund’s return may not match or achieve a high degree of correlation with the return of the underlying Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Index.

EQM Indexes is the Index Provider for the Fund. EQM Indexes is not affiliated with the Trust, the Investment Adviser, or the distributor. The Investment Adviser has entered into a license agreement with EQM Indexes to use the Emerging Markets FinTech Index. The Fund is entitled to use its Index pursuant to a sublicensing arrangement with the Investment Adviser.

Amplify Investments LLC serves as the investment advisor and Penserra Capital Management LLC serves as sub advisor to the fund. Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.