3 Key Investor Insights for 2023

In 2022, equity markets fell into bear territory and experienced the worst annual performance since 2008. The S&P 500, Dow and Nasdaq declined 19.4%, 8.8% and 33.1%, respectively last year. Inflation worsened as the Consumer Price Index climbed to a 40-year high of 9.1% in June. As a result, the Federal Reserve (Fed) hiked rates seven consecutive times from 0% last March to 4.25% in December. Along the way, a myriad of other events impacted markets, from the war in Ukraine to China’s zero-Covid policy, affecting everything from oil prices to the U.S. dollar.

These market swings can cause whiplash for even the most experienced investors. Like an earthquake that then causes a tsunami, the sudden drop and resurgence in demand, fiscal and monetary stimulus, and global supply chain capacity since 2020 have created shock waves across the financial system.

Despite these historic shifts in the economy and markets over the past year, the principles of long-term investing haven’t changed. Staying focused on longer time horizons is more important than ever. After all, this is how it felt in March of 2020 before the rapid recovery, in 2008 before a decade-long expansion, and during countless other times across history.

Below, we review three insights from the past year that can help investors to maintain a proper long-term perspective in 2023.

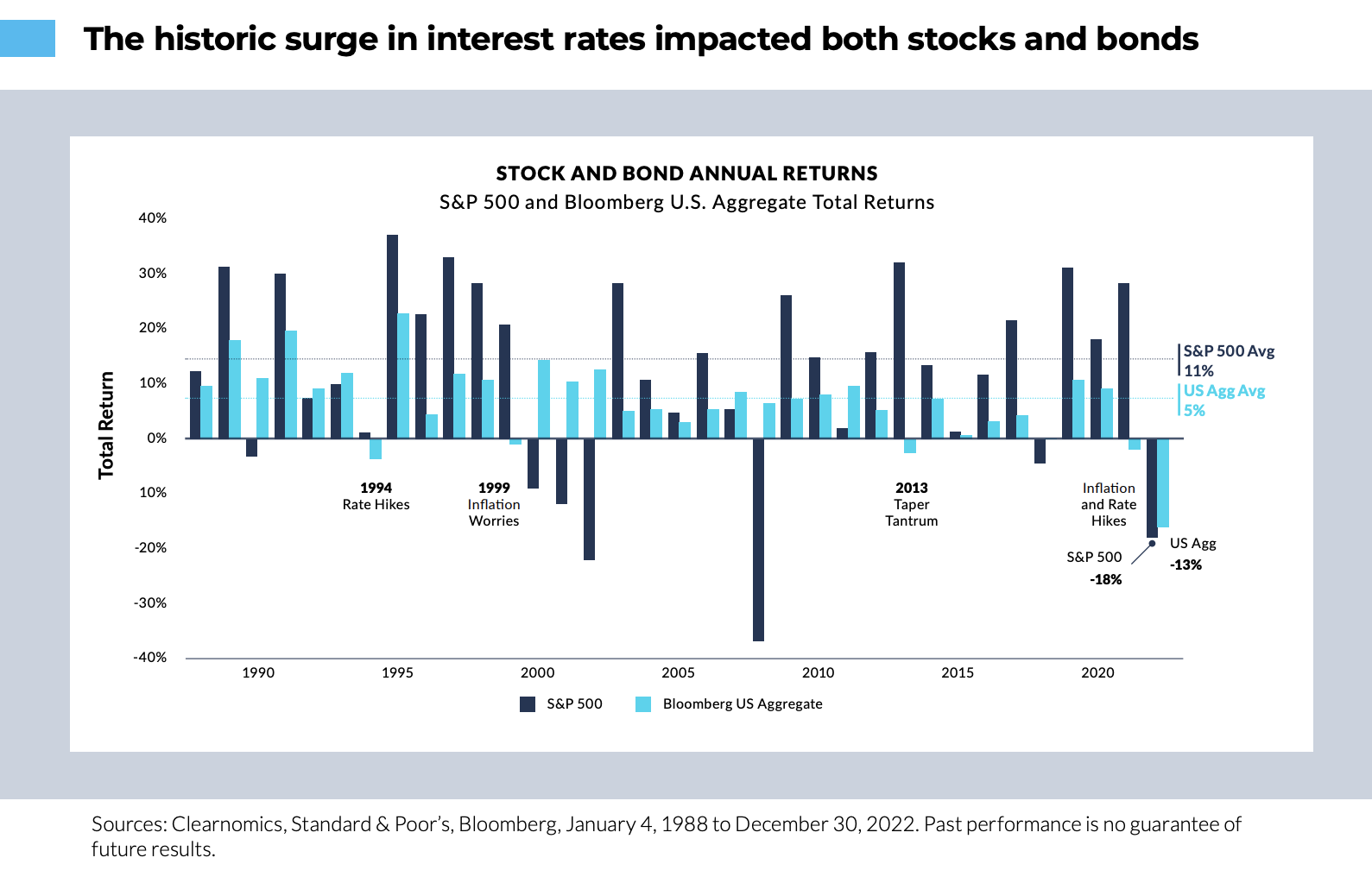

Beneath all of the headlines and day-to-day market noise, one key factor drove markets: the surge in interest rates broke their 40-year declining trend. Since the late 1980s, falling rates have helped to boost both stock and bond prices. Over the past year, the jump in inflation pushed nominal rates higher and forced the Fed to hike policy rates. This led to declines across asset classes at the same time.

While this has created challenges for diversification, there is also reason for optimism. Most inflation measures are showing signs of easing, even if they are still elevated. This has allowed interest rates to settle back down in recent months, even as the Fed continues to hike rates. While still highly uncertain, most economists expect inflation and rates to ease over the next year rather than repeat the patterns of 2022.

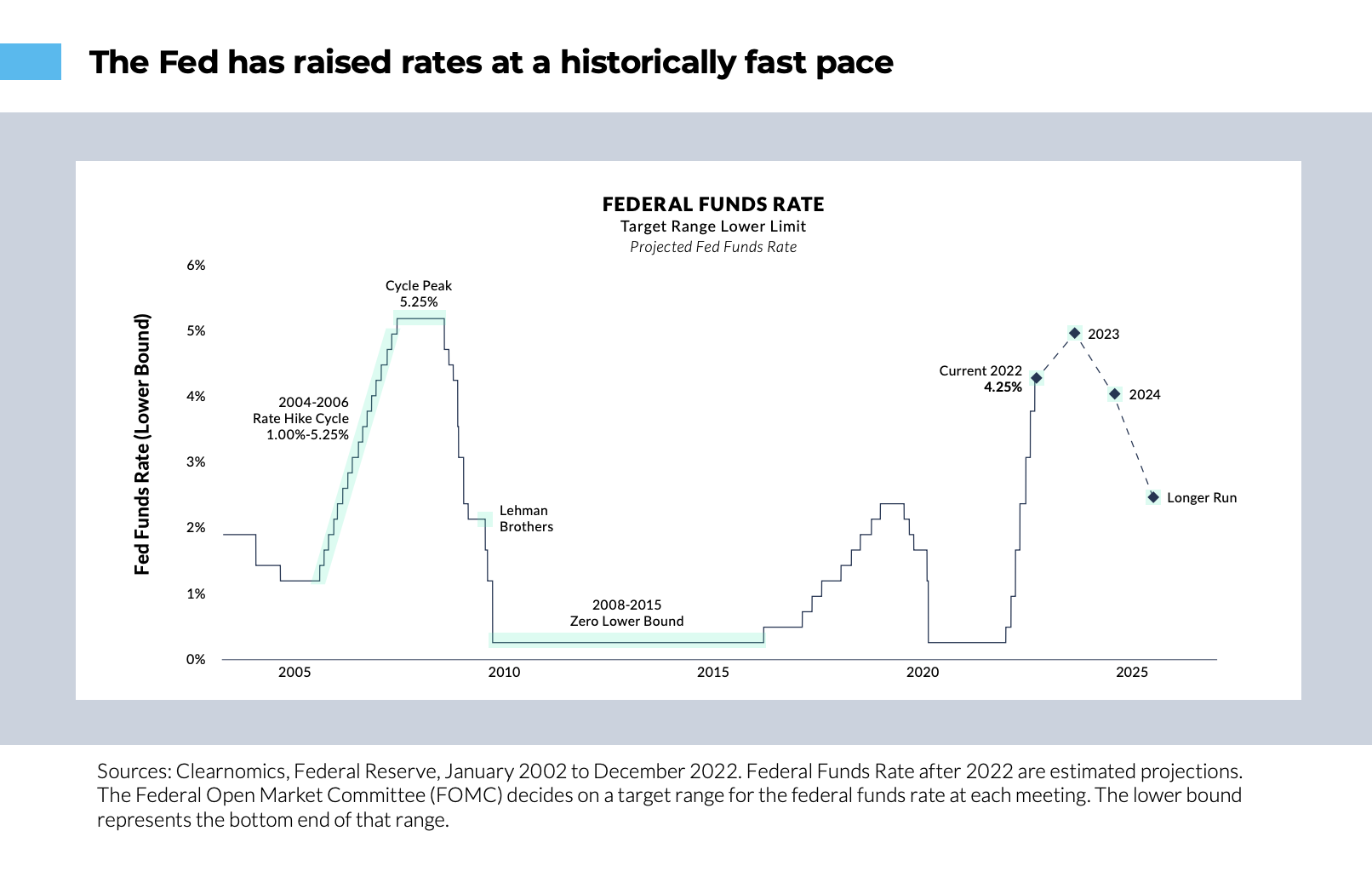

The Fed hiked rates across seven consecutive meetings in 2022, including four 75 basis point (0.75%) hikes in a row. At a range of 4.25% to 4.50%, the fed funds rate is now the highest since the housing bubble prior to 2008. In its communication, the Fed has remained committed to raising rates further and keeping them higher for longer in order to fight inflation.

This is where the market arguably had unrealistic expectations last year. The market rally from June to August, and again in October and November, occurred when investors believed the Fed might begin loosening policy. When these hopes were dashed, markets promptly turned around, causing several back-and-forth swings over the course of the year. These episodes show that good news that is supported by data can be priced in quickly, but investors should not get ahead of themselves.

At this point, the direction of inflation may matter to markets more than the level. Investors have been eager to see signs of improvement across both headline and core inflation measures, and good news has been priced in rapidly. There are reasons to expect better inflation numbers over the course of 2023.

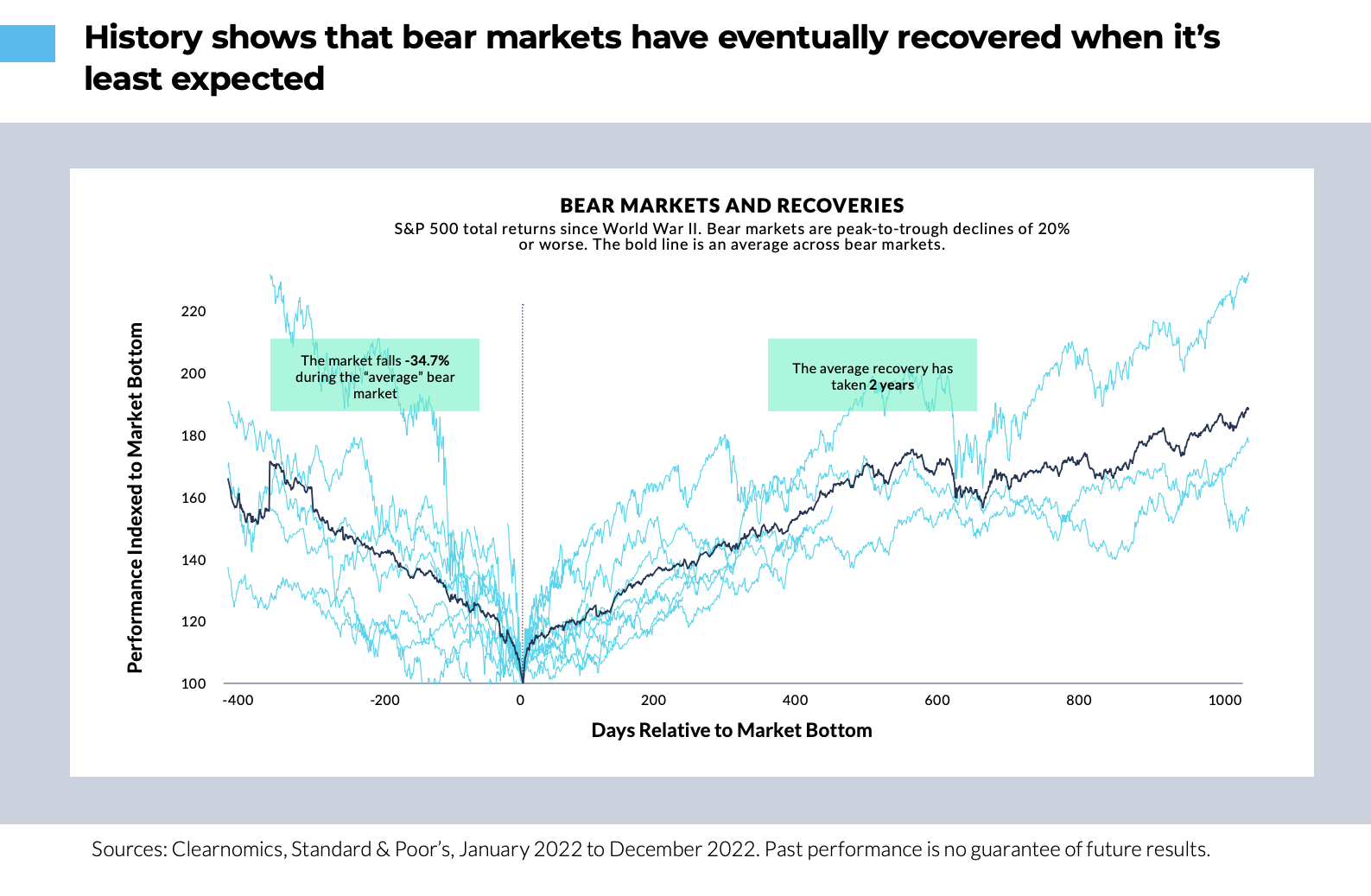

While 2022 was challenging, history shows that markets can turn around when investors least expect it. While it can take two years for the average bear market to fully recover, it’s difficult if not impossible to predict when the inflection point will occur.

Many investors have wished that they could go back to mid-2020 or 2008 and jumped back into the market. If research and history tell us anything, it’s better and easier to simply stay invested rather than attempt to time the market. This could be true again in 2023, just as it was during previous bear market cycles.

________________________________________________________________________________________________

Basis points are a unit of measure used to describe percentages in the financial industry. One basis point is equivalent to 0.01%.

Indexes are unmanaged and it’s not possible to invest directly in an index. The S&P 500 Total Return Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The Bloomberg U.S. Aggregate Bond Index tracks the performance of U.S. investment-grade bonds.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by calling 855-267-3837, or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. It is not possible to invest directly in an index.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.