BlackSwan Risks on the Horizon

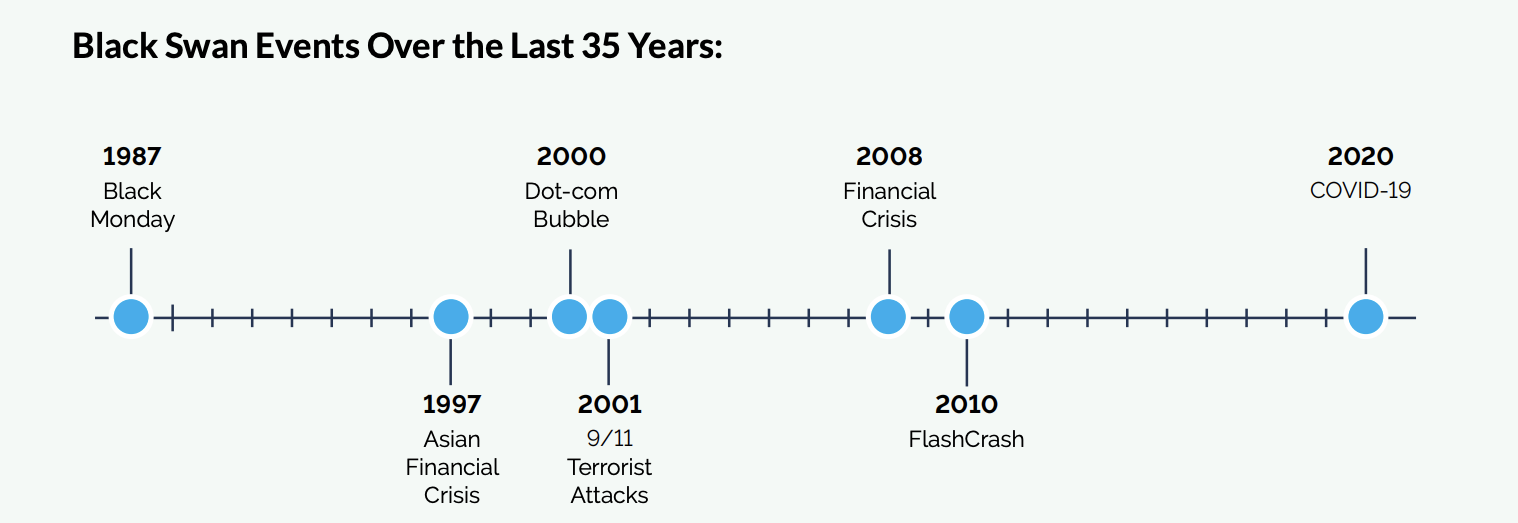

It’s easy to look back at previous market selloffs and wonder how market participants did not see all the warning signs of an imminent selloff.

But the very nature of black swan events makes them difficult, if not impossible, to predict. Below are a handful of events that sparked selloffs in the equity markets that few could have predicted.

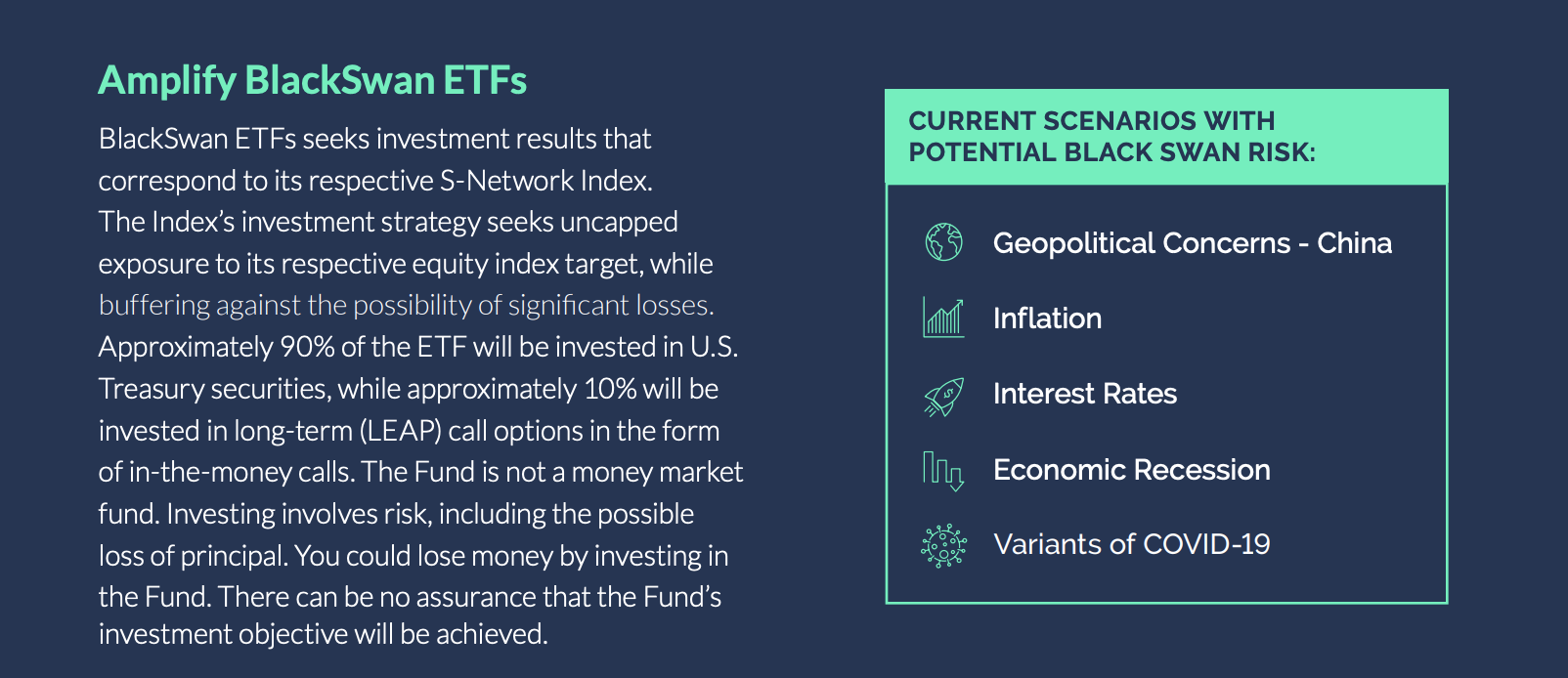

We cannot always predict the potential black swan events that can impact the market. What we can do is identify some of the potential threats to be continued market prominence. Remember, we need to take these with a grain of salt and understand that while these could happen, we are not indicating any of these scenarios are going to imminently retaining the potential for upside participation.

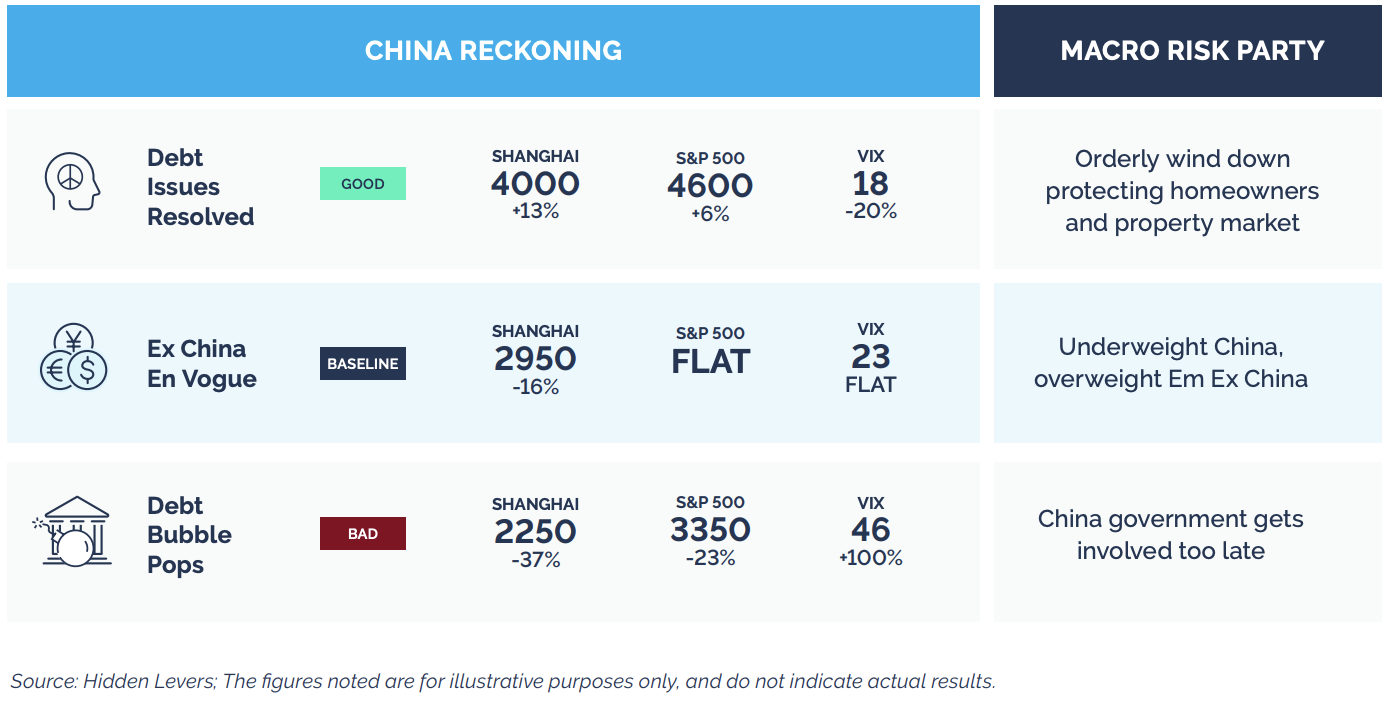

Scenario 1: Geopolitical Concerns – China

We have seen markets move rapidly on geopolitical news regarding China. Over the last year, China has kicked off an extensive crackdown on its most powerful corporation revolving around the technology sector. This heightened regulatory tightening has caused foreign capital to look elsewhere for emerging market growth opportunities. This is causing many to question the endgame of this tightening cycle and the growth aspects of the Chinese markets as the government looks to re-establish control.

How Amplify BlackSwan ETFs May Benefit Investors:

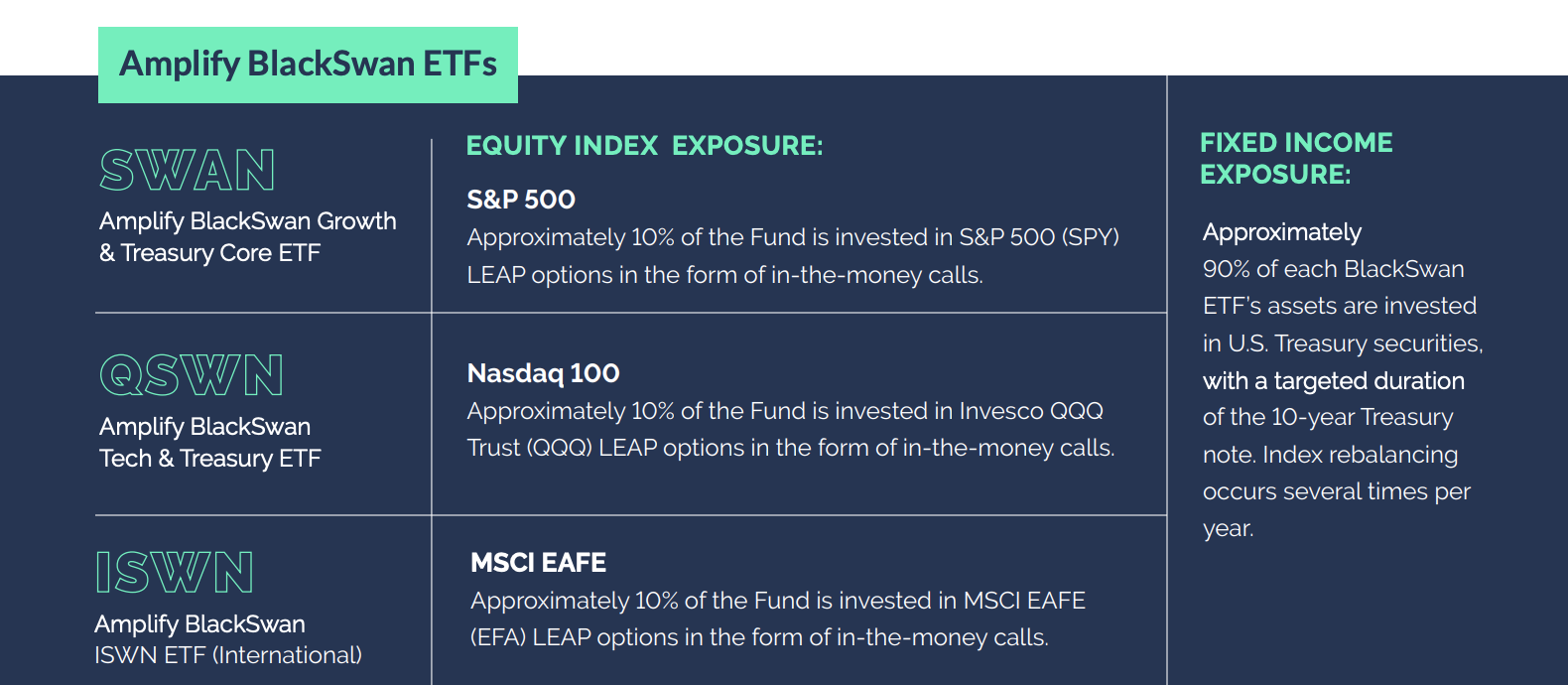

If China's crackdown of large tech-centric businesses continues and affects global markets. The BlackSwan ETFs seek to provide protection from significant losses, as investors move to the safety of US Treasuries, the 90% allocation to Treasuries is positioned to take advantage.

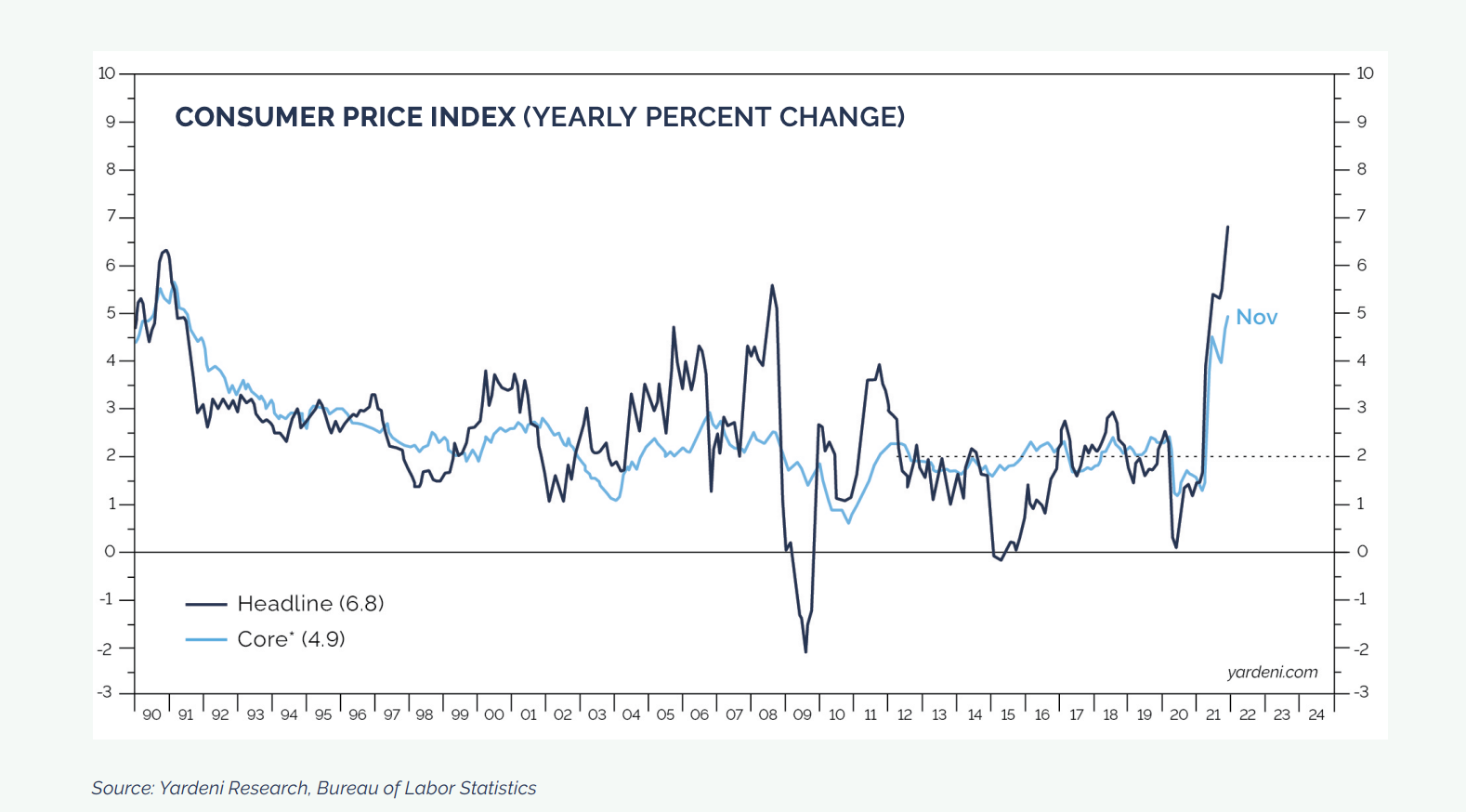

Scenario 2: Inflation

Consumer prices have been on the rise the United States with an average over 6 percent year over year change. Inflation has run hot at an average of 3.2%, still higher than the Federal Reserve's target of 2%. Can the Fed properly manage inflation, or will the Fed have to step in to alleviate the markets?

How Amplify BlackSwan ETFs May Benefit Investors:

If the Fed can properly manage inflation, the equity market could continue to do well, the Amplify BlackSwan ETFs is positioned in continued upside with the allocation to equity market options. If inflation rises higher than Fed expectations, BlackSwan may suffer in the short-term, but equities have proven to be a good long-term hedge against inflation.

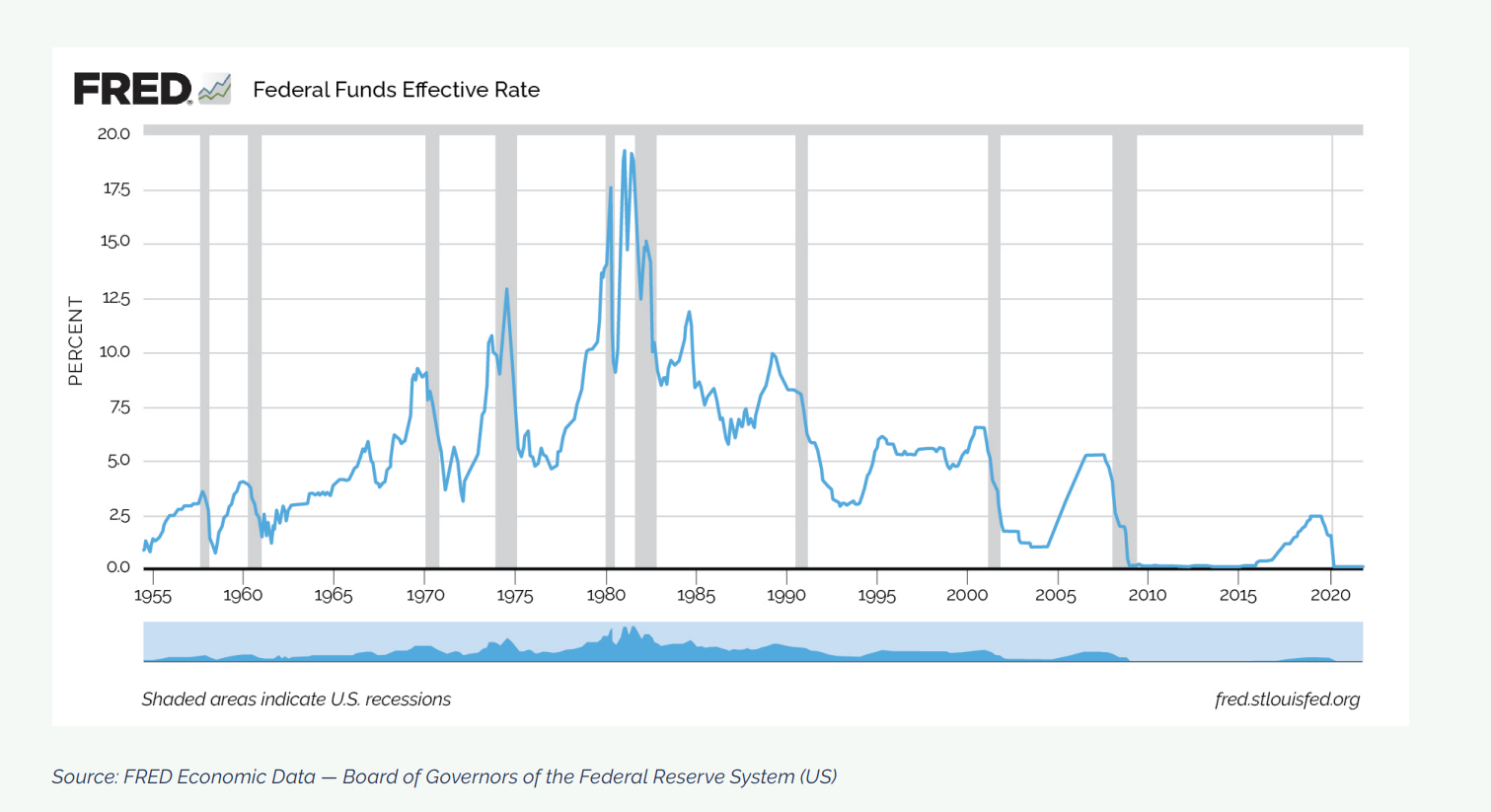

Scenario 3: Interest Rates

Since the emergence of the COVID-19 virus, the Federal Reserve took decisive action to lower interest rates to combat an economic recession as the world shut down. Since the lowering of rates, the economy has roared back to record highs, lower unemployment, but higher inflation readings. Once again, will the Fed have to take decisive action to combat higher inflation by raising interest rates?

How Amplify BlackSwan ETFs May Benefit Investors:

If the Fed decides to raise interest rates, the fixed income allocation will lag, as any bond allocation would, in a rising rate environment. However, the equity option allocation is poised to perform well in those times. Only four times since 1926, have we had a rising rate and falling stock market environment.

Scenario 4: Economic Recession

There is a pathway to an economic slowdown in the U.S. where consumers start spending less, causing business hiring to slow. This could cause the job market to lose momentum and further reduce consumer spending, thus creating a downward spiral.

How Amplify BlackSwan ETFs May Benefit Investors:

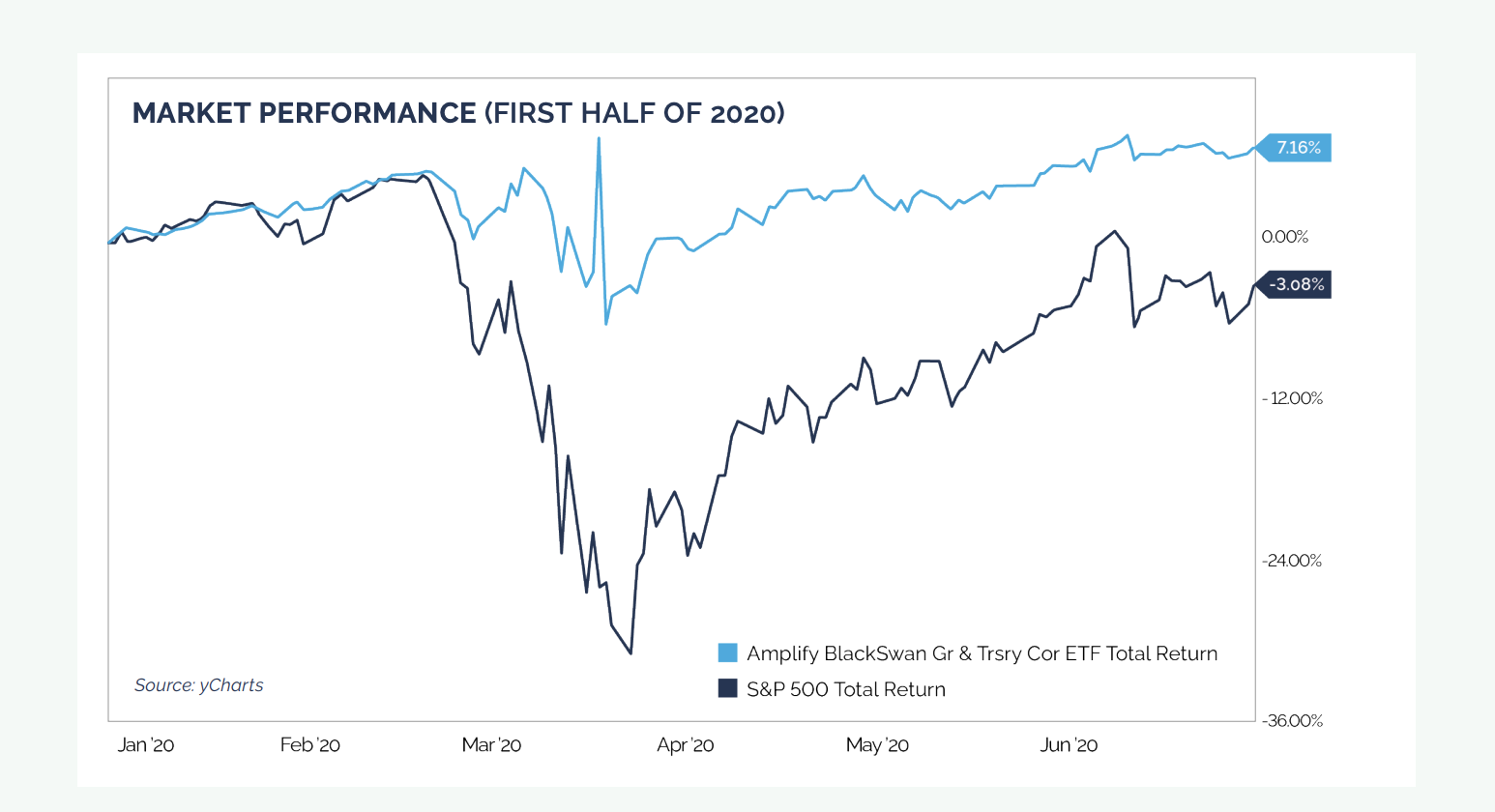

The BlackSwan ETF Suite seeks to protect against significant losses when equity markets turn in recessions by providing the fight-to-safety of the US Treasury allocation. As an example, the graph above shows the performance of SWAN compared to the S&P 500 index in the first two quarters of 2020.

To obtain standardized performance current to the most recent quarter please click amplifyetfs.com/swan

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns.

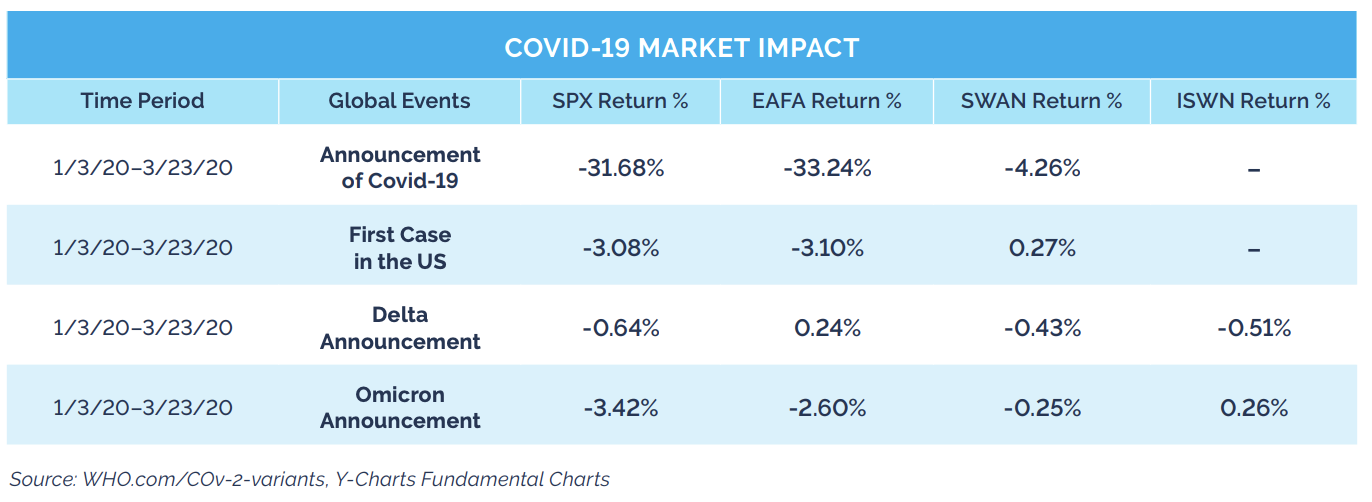

Scenario 5: Variants of COVID-19

In recent news, the global market has seen the introduction of a new COVID-19 variant known as Omicron. These new variants bring fear to the financial markets as threats of restriction and lockdown renew to combat the spread of the virus around the world. The introduction of new variant is a trend that will continue to happen periodically due to mutation of the virus. Whether these variants are more contagious or deadly, takes time to accumulate the data and could pose serious threats to markets.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837, or by visiting AmplifyETFs. com. Read the prospectus carefully before investing.

The Fund is not a money market fund.

The Fund’s return may not match or achieve a high degree of correlation with the return of the underlying Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund had sought to replicate the Index. The use of derivative instruments, such as options contracts, can lead to losses because of adverse movements in the price or value of the underlying asset, index or rate, which may be magnified by certain features of the derivatives. Investing in options, including LEAP Options, and other instruments with option-type elements may increase the volatility and/or transaction expenses of the Fund. An option may expire without value, resulting in a loss of the Fund’s initial investment and may be less liquid and more volatile than an investment in the underlying securities. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Long-term equity anticipation securities (LEAPS) are publicly traded options contracts with expiration dates that are longer than one year. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund.

The S-Network BlackSwan Core Total Return Index (Ticker: SWANXT) holds U.S. Treasury securities and SPY LEAP Options. On each rebalancing date, the Index targets 90% of its index market capitalization in U.S. Treasury securities and 10% targets of its index market capitalization in SPY LEAP Options. The weighting of U.S. Treasury securities is determined by the option reconstitution schedule. The S-Network BlackSwan Core Total Return Index is a trademark of the Index Provider and has been licensed for use for certain purposes by the Adviser. The Index Provider is not affiliated with the Trust, the Adviser, either Sub-Adviser or the Distributor.

The Fund is entitled to use the Index pursuant to a sub-licensing agreement with the Adviser.

It is not possible to directly invest in an index.

An “in-the-money” call option contract is an option contract with a strike price that is below the current price of the underlying reference asset.

The Standard & Poor’s 500 Index - S&P 500 is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value.

Amplify Investments LLC is the Investment Adviser to the Fund, and ARGI Investment Services, LLC and Toroso Investments, LLC serve as the Investment Sub-Advisers.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.