BLOK-Chain Monthly Commentary July 2023

THE MANDATE

The Amplify Transformational Data Sharing ETF (BLOK) is an actively managed fund, seeking to identify the leading companies focused on the transformation and development of the blockchain and cryptocurrency markets. The managers focus on how companies can capture the growth, innovation, and disruption of the blockchain paradigm shift. The evolution of the internet has changed how people communicate. We believe growth companies that embrace blockchain evolution will capture secular growth trends that are accelerating and disrupting core processes in business. We think this is an important secular trend, as Gartner forecasts business value generated by the blockchain could be $176 billion by 2025, and $3.1 trillion by 2030.

FIRST HALF OF 2023 REVIEW

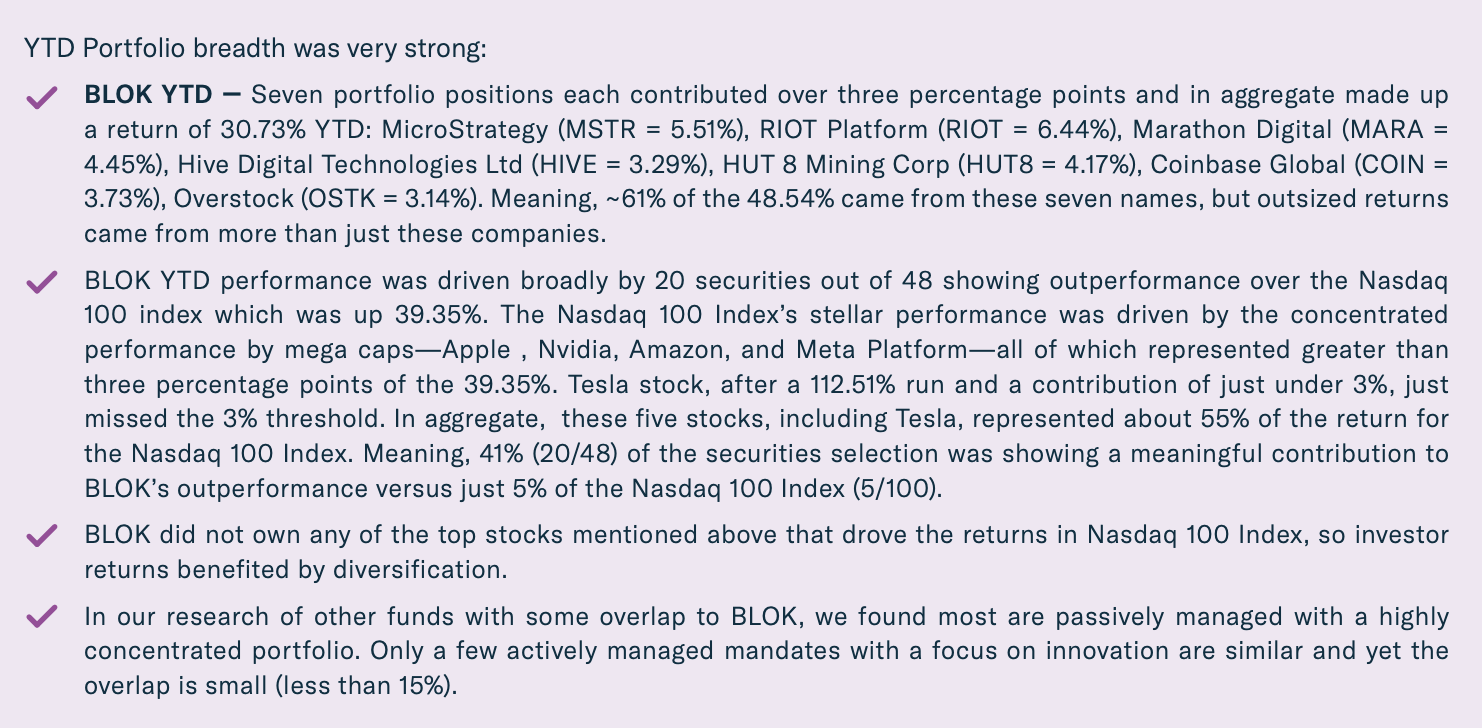

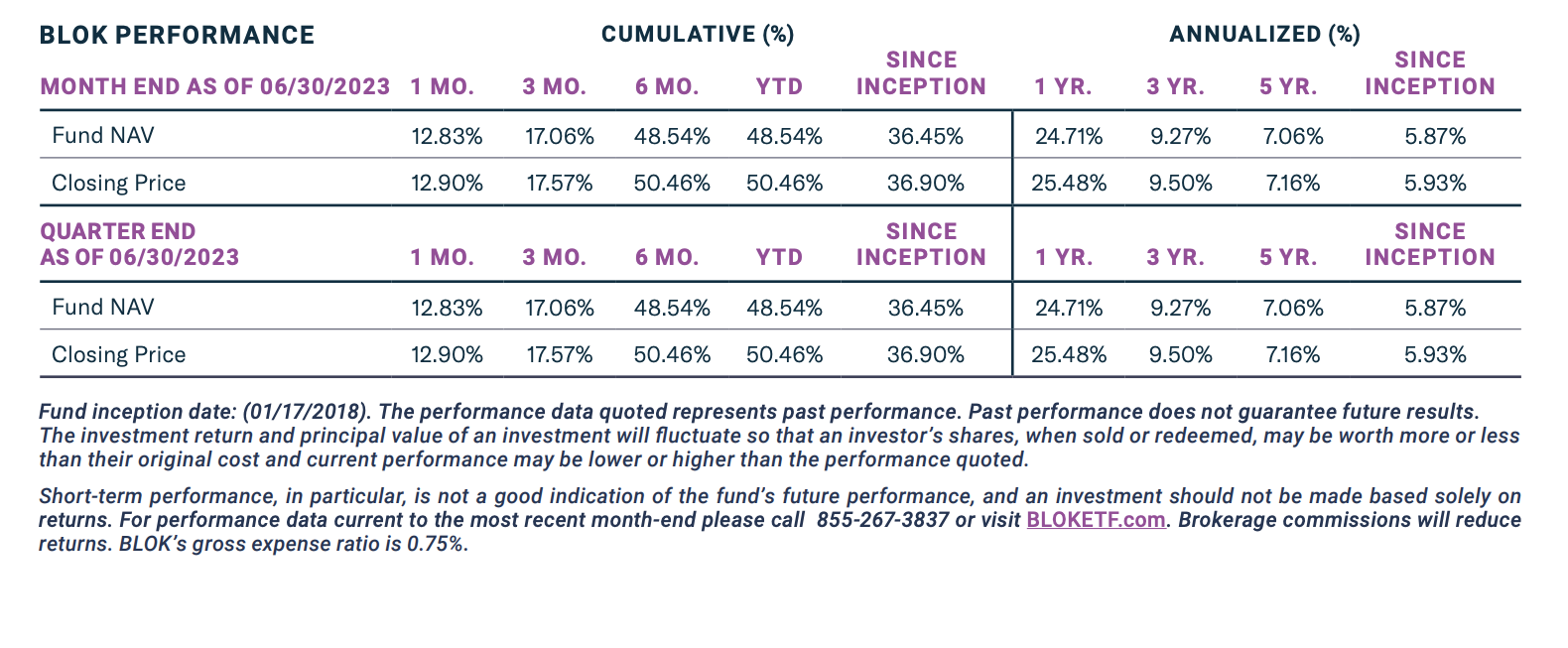

2023 equity returns showing transformational change by companies isn’t always neat, but when investors pay attention and have patience, returns may follow. The Fund for the month of June was up 12.83%, which brings the performance for the Quarter and YTD to 17.06% and 48.54%, respectively. This sharp rebound over last year reflects the dynamic nature of disruption expected from the change that is expected to occur through digital assets and blockchain. In addition, what is noteworthy about this performance is that it was earned with a high active share and minimal concentration as compared to the broad indexes or better-known growth funds.

We think these statistics demonstrate the robustness of BLOK’s investment process and how the strategy is keenly differentiated. To this point, as a further example, we think it is important to update our investors on the transformational change that will begin in July with Overstock (OSTK) rebranding to become Bed Bath & Beyond. We think companies looking to achieve transformational change, whether that be from data sharing, blockchain, or digital assets, are aligned with our core mandate around innovation. Dating back to the Fund’s launched in 2018, we are looking for a mindset that is bigger than just the internet, the price action of digital assets, and even AI. The companies that we are investing in are about executing on these paradigm shifts that are willing to be bold to capture or evolve with disruption. Rarely does a company invest 5-7% of its treasury, or $21.5 million, to achieve a 21X return on that value. Not a typo! Moreover, while the approximate increase of $450 million in market value from about $800 million may seem high to some, it arguably is more a function of how so many investors and analysts gave up on Overstock. It is for this reason, we believe that the rebound may be just beginning. The oversold price of the stock was more a function of the perception around a contracting retail business anchored by an offering that led with discounting. After the rebranding, it makes for a growth company with relatively easy comps, a 4x increase in customer reach, and scalability in the firm’s business model. In addition, if management executes effectively and increases sales as the new Bed Bath & Beyond, we think customers and Wall Street perception will be materially changed. Lastly, we would highlight the company’s balance sheet remains with net cash (no debt) of over $300 million ($7-8 per share) and a portfolio of blockchain companies with attractive risk/reward characteristics. Again, we would encourage investors to listen to the Medici Venture Day2 where four CEO’s from the portfolio are interviewed: tZERO3, GrainChain4, SettleMint5 and PeerNova6. Our optimism for Overstock as a “core holding” has been no secret as it has been highlighted a few times in these updates, but as the stock and company is transformed to Bed Bath & Beyond (formerly Overstock), investors should remember that our discipline of trimming our winners sometimes is a function of our focus on diversification and portfolio risk management.

REGULATION

We covered a lot about regulation in our piece last month and generally our biases are known. Bottom line, more guidance from Congress and the SEC would be appreciated and we believe we are getting closer, not farther, to an outcome as a result of litigation, brand name adoption, and some lobbyist efforts. Skeptics around crypto and evidence of fraudulent outcomes will continue, but let’s not forget that did not stop the progress of the internet. Moreover, speculation and excitement by investors around the filings to launch a spot Bitcoin ETF is clearly going to bring the launch of an ETF sooner rather than later. Whether the launch comes in Q4 2023 or early 2024, the timing of the new effort provides more evidence of adoption and foundational price support for the asset class, even if it is just for Bitcoin. For those looking for a target date of the launch? Wouldn’t it be ironic if the ETF launch took place in April 2024 on the date of the bitcoin halving (countdown website: https://www.nicehash.com/countdown/btc-halving-2024-05-10-12-00).

TRANSACTION AND REPOSITIONING

As a reminder, we tend to move incrementally in our portfolio process given the opportunities we are constantly reviewing. The expanding database of blockchain and digital assets companies could exceed 400 public companies by year end which demonstrates the opportunity set we are screening through when we are making changes to the portfolio.

What was Sold or Trimmed?

We are always seeking to manage risk and the ETF wrapper allows us, as an active manager, to take profits without tax consequences. Of course, given the nature of the technological change we are seeking to capture and the natural volatility of the digital asset space this can be a challenge. Nevertheless, we have some strict guidelines that we follow. We sold Splunk and trimmed both Coinbase and RIOT Platforms as a result. The decision to sell Splunk was because the firm no longer was emphasizing blockchain as a means for growth according to our sources. We remain optimistic around Coinbase as a core holding and RIOT needed to be trimmed due to risk controls around conditions, size constraints, and geographic concentration in Texas. We also own Marathon Digital, which also has production in Texas. We trimmed WisdomTree (WT) as well.

What was Bought or Increased? — Emerging Mark

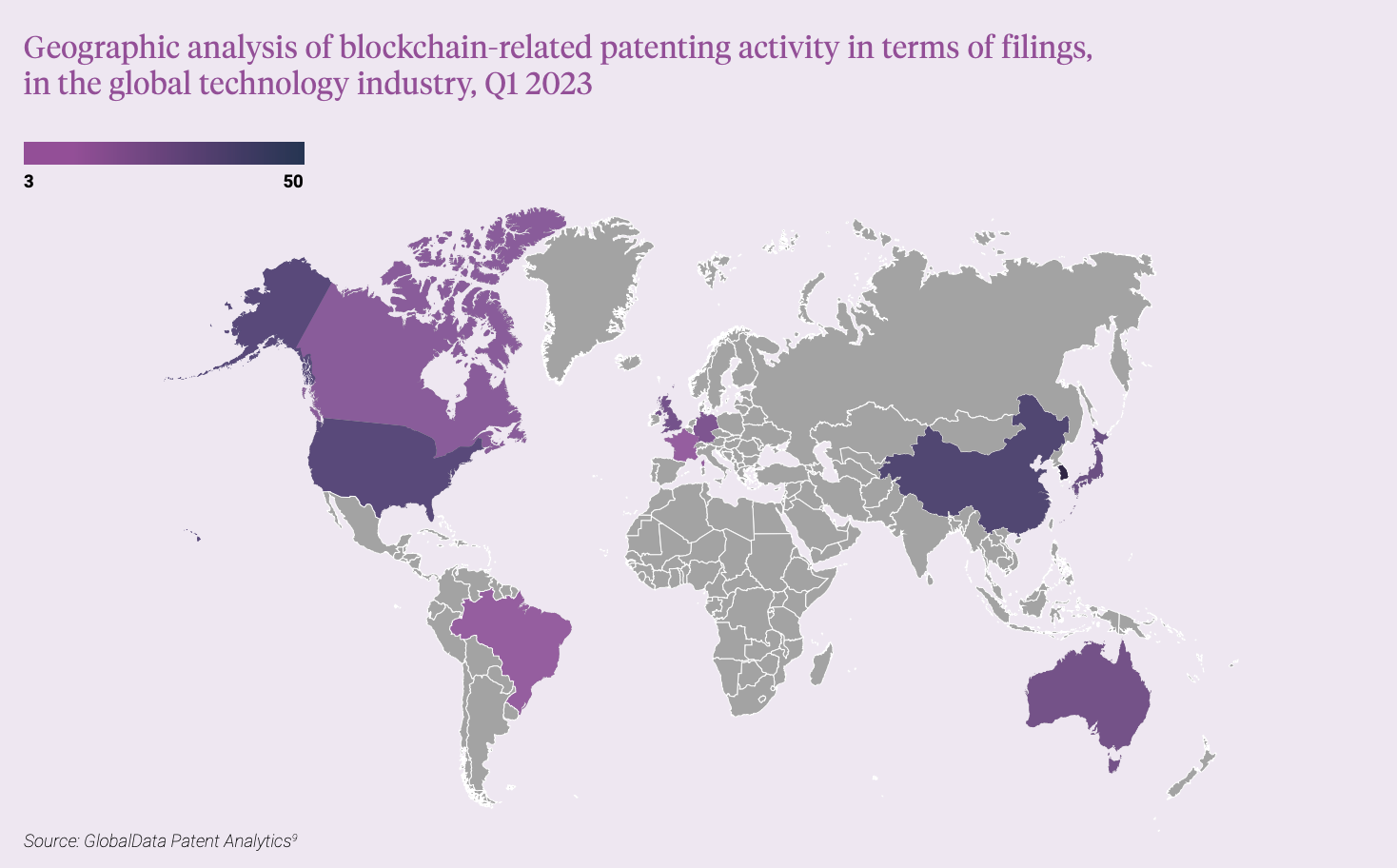

Citizens living in America should feel fortunate because of our country’s ability to foster and inspire innovation and entrepreneurship. However, the blockchain and digital asset revolution is not just a U.S. evolution. In fact, in many ways, the benefits that may arise from digital assets may come at the expense of U.S. companies who are not able or willing to embrace the change that is coming. Moreover, while most U.S. investors and our politicians may look at digital assets as an asset class, in many ways the changes taking place in the emerging markets is both at the forefront of potentially building a new financial system as a way of life and providing a new competitive edge around the blockchain technology. With this in mind, we have started to increase our allocation further outside of the U.S. since so much of the “use case” and adoption is also continuing to build momentum.

The portfolio increased its investment in DBS Group and Canaan, but also added four new allocations to Alibaba, MercadoLibre, Nasdaq, and Franklin Resources. Some brief highlights are listed below:

■Alibaba Group (BABA): We have been following Alibaba’s strategy around blockchain and digital assets for many years and would highlight that they were the #1 filer of Blockchain patents in 2020. With about 98,553 patents today, BABA with their Ant Group has long been an aggressive patent filer around Blockchain.10 We classify BABA in the Conglomerate category of the portfolio but given how the company is getting divided up, this transformation will be important to watch; especially as the Chinese government looks to be reforming its outlook on crypto.11

■ MercadoLibre (MELI) is frequently referred to as the Amazon of Brazil. The Company recently launched a digital wallet. This service allows millions of users to purchase, hold, and sell selected digital assets without leaving the Mercado Pago application. We think MELI is well positioned as a leading Fintech company in Latin America and has been categorized under Applications for purposes of portfolio construction.

■ Nasdaq (NDAQ): Led by Adena Friedman as the CEO, NDAQ has been making bold moves to transform its business beyond just making money from trading. To this point, they recently agreed to acquire Adenza for $10.5 billion in cash and stock and have been building out their digital asset team aggressively.

■ Franklin Resources (BEN): The CEO of Franklin Resources (BEN), Jennifer Johnson, was a keynote speaker at Consensus and has been a long-time advocate of crypto. She has been aggressively transforming the Company through acquisitions and today the firm manages nearly $1.4 trillion (AUM). The catalyst for the purchase was the acquisition of Putnam Investments12 which brings in an additional $136 billion AUM. Franklin offers SMA strategies in crypto, a money market fund that uses the Polygon blockchain and venture capital. While the media is focused on the Blackrock and Fidelity ETF filings, we think this trillion-asset manager is moving fast to also go where the puck is headed.13, 14 In the portfolio strategy, as an asset manager, BEN's business blockchain strategy is categorized as Transactional.

EDUCATION

For those who just want to get educated on the blockchain, here are some links:

■ Fun Blockchain and Digital Assets statistics:

• Evidence that digital assets are an asset class: 10% of the global population owns cryptocurrencies and 16% of Americans have invested in cryptocurrency. • With a compound annual growth rate (CAGR) of 56.3%, the blockchain industry will be worth $163.83 billion by 2029.

■ A great interview by Eric Balchunas and Joel Weber about the evolution of ETF regulation with three term regulatory veteran Dalia Blass, a partner now at Sullivan & Cromell:

• Trillions: ETF Lawyer-Regulator-Industry Veteran Dalia Blass - Trillions | Podcast on Spotify

■ Satoshi Nakamoto Original Bitcoin White paper: Bitcoin: A Peer-to-Peer Electronic Cash System

SUMMARY

The Fund for the month of June was up 12.83%, which brings the performance for the quarter and YTD to 17.06% and 48.54%, respectively. This sharp rebound over last year reflects the dynamic nature of disruption expected from the change that is expected to occur through digital assets and blockchain. This performance was particularly positive given the broad outperformance with 20 holdings in the portfolio outperforming even the Nasdaq 100 Index. Transformation comes in many forms, but the universe of dynamic companies is now approaching 400 companies. The portfolio increased its investments outside of the U.S., aka Alibaba, MercadoLibre, DBS Group, and Canaan.Thank you again for your faith and inquiries. We welcome engaged investors as they challenge us with great questions.

Disclosure

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by calling 855-267-3837, or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Click HERE for BLOK’s top 10 holdings.

Click HERE for BLOK’s prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. The Fund’s return may not match or achieve a high degree of correlation with the return of the underlying index.

The Fund is subject to management risk because it is actively managed. Narrowly focused investments typically exhibit higher volatility. A portfolio concentrated in a single industry, such as companies actively engaged in blockchain technology, makes it vulnerable to factors affecting the companies. The Fund may face more risks than if it were diversified broadly over numerous industries or sectors. Blockchain technology may never develop optimized transactional processes that lead to realized economic returns for any company in which the Fund invests.

The Fund invests at least 80% of the Fund’s net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies. Such investments may be subject to the following risks: the technology is new and many of its uses may be untested; theft, loss or destruction; competing platforms and technologies; cybersecurity incidents; developmental risk; lack of liquid markets; possible manipulation of blockchain-based assets; lack of regulation; third party product defects or vulnerabilities; reliance on the Internet; and line of business risk. The investable universe may include companies that partner with or invest in other companies that are engaged in transformational data sharing or companies that participate in blockchain industry consortiums. The Fund will invest in the securities of foreign companies. Securities issued by foreign companies present risks beyond those of securities of U.S. issuers.

The Fund may have exposure to cryptocurrencies such as bitcoin indirectly through investment funds, including through an investment in the Bitcoin Investment Trust ("GBTC"), a privately offered, open-end investment vehicle. Even when held indirectly, investment vehicles like GBTC may be affected by the high volatility associated with cryptocurrency exposure. Holding privately offered investment vehicle in its portfolio may cause the Fund to trade at a premium or discount to NAV. Many significant aspects of the U.S. federal income tax treatment of investments in cryptocurrencies are uncertain and such investments, even indirectly, may produce non-qualifying in- come for purposes of the favorable U.S. federal income tax treatment generally accorded to regulated investment companies.

Amplify Investments LLC is the Investment Adviser to the Fund, and Tidal Investments, LLC serves as the Investment Sub-Adviser.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.