BLOK-Chain Monthly Commentary June 2023

THE MANDATE

The Amplify Transformational Data Sharing ETF (BLOK) is an actively managed fund, seeking to identify the leading companies focused on the transformation and development of the blockchain and cryptocurrency markets. The managers focus on how companies can capture the growth, innovation, and disruption of the blockchain paradigm shift. The evolution of the internet has changed how people communicate. We believe growth companies that embrace blockchain evolution will capture secular growth trends that are accelerating and disrupting core processes in business. We think this is an important secular trend, as Gartner forecasts business value generated by the blockchain could be $176 billion by 2025, and $3.1 trillion by 2030 .

MAY MONTHLY

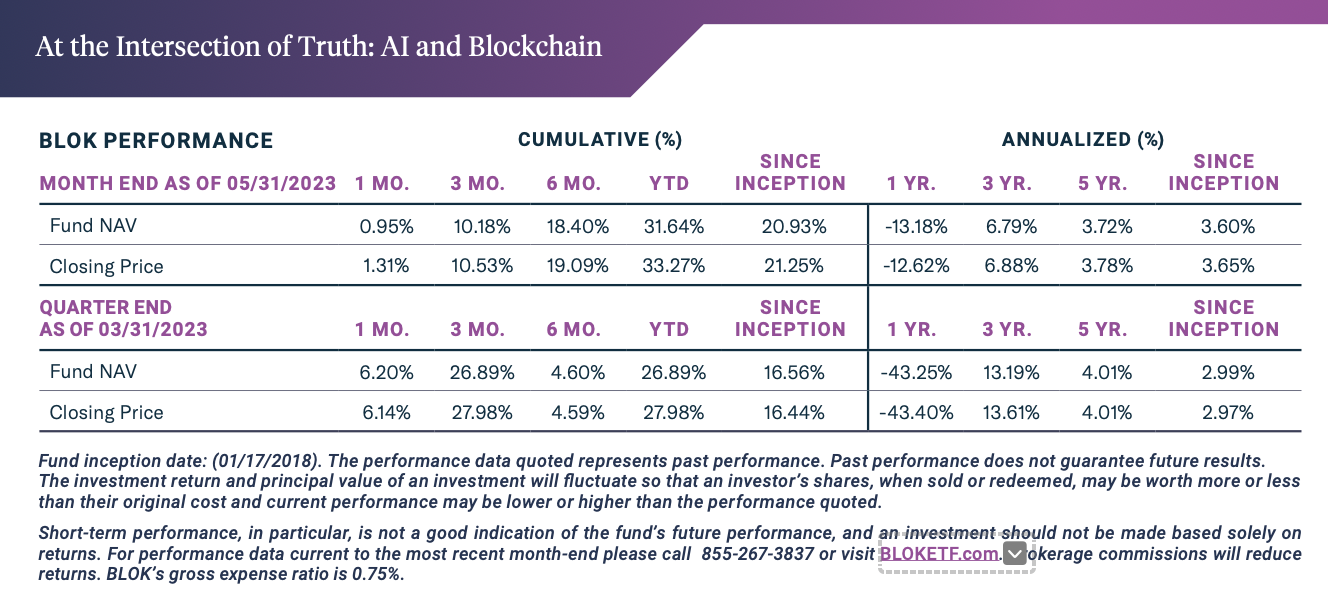

The Fund increased 0.95% in May and is up 31.64% YTD in 2023. While AI has stolen the spotlight as of late, we believe Blockchain and AI are intertwined at the intersection of truth. Meaning, we see a great deal of alignment between AI and Blockchain due to the benefits and efficiencies that AI provides to the blockchain technology. As a platform, the blockchain integrates with AI as it validates code to transfer immutable truths and value seamlessly. Of course, this thesis is early, but consider how ChatGPT could be used to write a contract between two parties, which would then get validated and embedded on the blockchain as immutable evidence of contract terms. All this could be aligned using established laws and executed with the ease and speed of AI. In addition, as the validators of truth, this could be a significant advancement for Web3.0, and further validation for the value of the infrastructure being built around bitcoin mining, which today is generating significantly more revenue from transactions than a year ago.

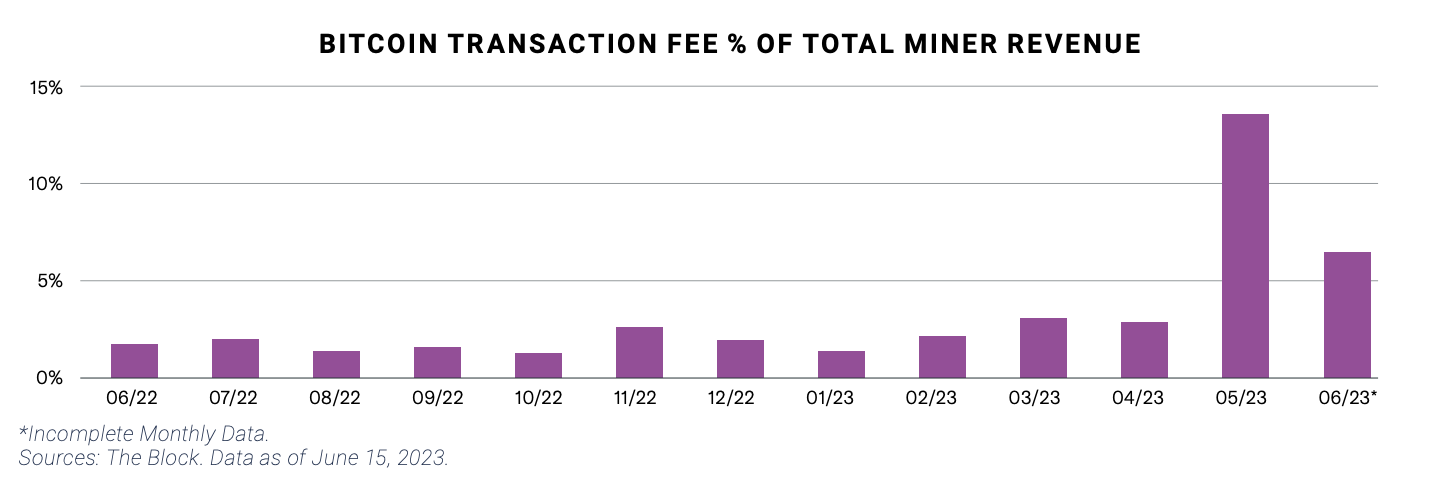

According to The Block, transaction volume of $120 million in May 2023 was 8 times higher than it was a year ago. This transaction volume makes up 13.70% of Bitcoin mining revenue as of May 2023, which compares to 1.79% in May 2022 and more recently, 2.93% in April 2023. Block reports that mining revenue in May was $916 million. While some may push back on the increase in transactional costs charged by miners, the increase in the service fee is evidence of demand and the utility value provided within the market opportunity. Such demand could suggest that the value proposition provided by the miners is expanding beyond just keeping the network secure, and more to the value proposition provided by Bitcoin itself.

Higher transactional volumes and prices may create some pushback from certain crypto users who are concerned about congestion within the network and having to pay more for slower service. Of course, the question is whether this sector continues to benefit from improving conditions around (1) higher bitcoin prices, (2) lower energy price, and (3) greater adoption of the utility proposition offered by Bitcoin.

REGULATION

Investors have legitimate concerns and confusion around the delays of evolution in digital asset regulation in the U.S, especially in the context of global progress as compared to other countries and regions. Even in China there seems to be new openness around the asset class. The Beijing Municipal Science and technology Commission and Zhongguancun Science and Technology Park Management released the Beijing Internet 5.27 Innovation and Development White paper on May 5th. The general consensus is that the release of this Web 3.0 paper suggests that the Chinese government may be open to it, since such a release would not happen without the government’s permission. In Hong Kong, regulators have offered clarity around KYC and other guidelines around Crypto trading and exchanges. As global regulations go, we would also point out that the European Union (EU) offers a comprehensive policy called markets in Crypto-Assets (MiCA). Our point is that the regulatory path here in the U.S. is not necessarily clear, and impatience is warranted, but that does not mean that we won’t eventually find a regulatory path. In fact, if an investor is truly thinking long-term, they would be arguing that the discussions that are currently taking place in Congress are a much more significant step forward than backward steps that the SEC seems to be taking. See proposed legislation by Patrick McHenry (R), North Carolina, and Glenn Thomson (R), North Carolina, on the Hearing scheduled for June 13th Entitled: The Future of Digital Assets: providing Clarity for the Digital Asset Ecosystem. Whether the American government sees digital assets as a technology, store of value or means to transfer value remains to be seen, but it seems evident that forward progress is visible. With a change in tone and real representation from Congress, we now have a seat at the table. Don’t misunderstand our message: it is with deep regret that we see our SEC Chairman threatened to be fired through legislation from Congress by Congressman Warren Davidson.

TRANSACTION AND REPOSITIONING

Unlike April, we did not make a lot of shifts in May. The biggest change we made was leaving New York Community Bank (NYCB) in favor of adding DBS Group. Meaning, while we moved out of NYCB, we did so with the intent of adding DBS Group (DBS SP) to the portfolio. Few in America may be familiar with DBS Group, which is domiciled in Singapore, but in Asia DBS is extremely well known as an innovative and conservative financial service firm. Moreover, according to many analysts, it is well capitalized and an innovation leader in the region. This is a bank that is positioned to embrace blockchain and crypto in many ways given its strategic positioning and its geographic position. Since blockchain is such a global phenomenon, investors in BLOK should watch for us to seek further diversification in our geographic mix. All eyes seem to be on the U.S. these days, and we did increase our exposure in BLOCK Inc (SQ) and Paypal Holdings (PYPL) in May, but it is clear that digital assets and blockchain will impact more than just the US. The decision to increase SQ and PYPL was mostly a function of their advantaged positioning in facilitating trading in Bitcoin and their pursuit of innovation.

EDUCATION

For those who just want to get educated about blockchain and regulations, here are some links:

■ NYDig Research: https://nydig.com/research/bitcoins-backlog-is-a-benefit-to-miners

■ Podcast: Blockchain Intelligence Podcast with Joe Burnett Spotify: https://open.spotify.com/ episode/1H9MpqPRsd2hZ9R2aqLAz5?si=2IU_CE3mTz-ZXNanh0t0Dg

■ Satoshi Nakamoto Original Bitcoin White paper: Bitcoin: A Peer-to-Peer Electronic Cash System https://bitcoin.org/bitcoin.pdf

SUMMARY

As a point of fact, the transformation and innovation around data sharing across industries does not necessarily align well with established laws and regulations. Investors, as a result, must think outside the box about the long-term implications of such change. We thank you for your confidence in us as portfolio managers and hope to continue to deliver strong performance in 2023 and beyond. Every day we seem to be expanding the universe of opportunities by building out our database of companies in our research. We appreciate that the easiest and most tangible way to measure the progress around Blockchain is the price action of Bitcoin, but this arguably is a narrow view. Blockchain and Bitcoin/Digital Assets are a technology paradigm that are changing lives every day.

Disclosure

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by calling 855-267-3837, or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Click HERE for BLOK’s top 10 holdings.

Click HERE for BLOK’s prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. The Fund’s return may not match or achieve a high degree of correlation with the return of the underlying index.

The Fund is subject to management risk because it is actively managed. Narrowly focused investments typically exhibit higher volatility. A portfolio concentrated in a single industry, such as companies actively engaged in blockchain technology, makes it vulnerable to factors affecting the companies. The Fund may face more risks than if it were diversified broadly over numerous industries or sectors. Blockchain technology may never develop optimized transactional processes that lead to realized economic returns for any company in which the Fund invests.

The Fund invests at least 80% of the Fund’s net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies. Such investments may be subject to the following risks: the technology is new and many of its uses may be untested; theft, loss or destruction; competing platforms and technologies; cybersecurity incidents; developmental risk; lack of liquid markets; possible manipulation of blockchain-based assets; lack of regulation; third party product defects or vulnerabilities; reliance on the Internet; and line of business risk. The investable universe may include companies that partner with or invest in other companies that are engaged in transformational data sharing or companies that participate in blockchain industry consortiums. The Fund will invest in the securities of foreign companies. Securities issued by foreign companies present risks beyond those of securities of U.S. issuers.

The Fund may have exposure to cryptocurrencies such as bitcoin indirectly through investment funds, including through an investment in the Bitcoin Investment Trust ("GBTC"), a privately offered, open-end investment vehicle. Even when held indirectly, investment vehicles like GBTC may be affected by the high volatility associated with cryptocurrency exposure. Holding privately offered investment vehicle in its portfolio may cause the Fund to trade at a premium or discount to NAV. Many significant aspects of the U.S. federal income tax treatment of investments in cryptocurrencies are uncertain and such investments, even indirectly, may produce non-qualifying in- come for purposes of the favorable U.S. federal income tax treatment generally accorded to regulated investment companies.

Amplify Investments LLC is the Investment Adviser to the Fund, and Toroso Investments, LLC serves as the Investment Sub-Adviser.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.