NDIV Commentary February 2024

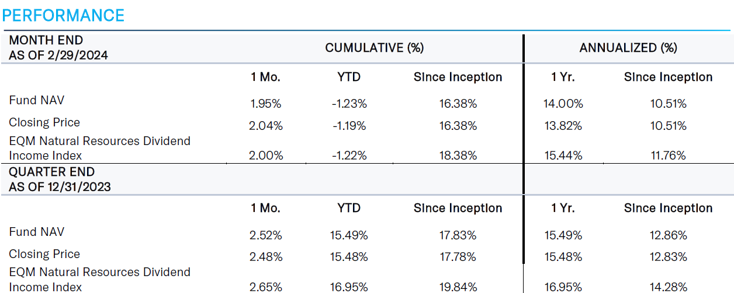

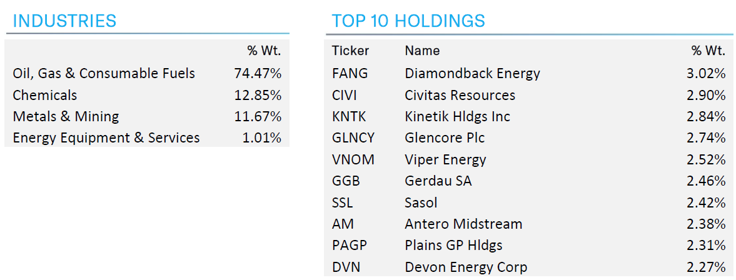

Amplify Natural Resources Dividend Income ETF (NDIV) seeks investment results that generally correspond to the price and yield of the EQM Natural Resources Dividend Income Index. The Index is comprised of dividend-paying U.S. exchange-listed equities operating primarily in the natural resource and commodity-related industries such as: energy, chemicals, agriculture, metals & mining, paper products, and timber. NDIV returned 1.95% on a net asset value (NAV) compared to its benchmark, the EQM Natural Resources Dividend Income Index at 2.00% for the month, as of February 29, 2024. Oil, gas & consumable fuels (+4.01%) contributed the most to the Fund’s return for the month, whereas metals & mining (-5.63%) and chemicals (-1.90%) detracted.1 Positions that contributed most significantly included Diamondback Energy (FANG), Viper Energy (VNOM) and Kinetik Holdings (KNTK). Positions that detracted most significantly included Glencore (GLNCY), Chemours (CC) and Sasol (SSL).

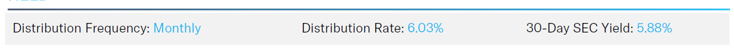

YIELD

Distribution Rate is computed as the normalized current distribution (annualized) over NAV per share. In addition to net interest income, distributions may include capital gains and return of capital (ROC). Please click here for more information. 30-Day SEC Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows for fairer comparisons among bond funds. It is based on the most recent month end. This figure reflects the income earned from dividends – excluding option income – during the period after deducting the Fund’s expenses for the period.

Fund inception date: 8/24/2022. NDIV’s gross expense ratio is 0.59%. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Brokerage commissions will reduce returns. A fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The closing price or market price is the most recent price at which the fund was traded.

All data as of 2/29/2024. Subject to change at any time. Fund holdings should not be considered recommendations to buy or sell any security. View Current Complete Holdings

Index Definitions: : The EQM Natural Resources Dividend Income Index (NDIVITR) is a gross total return index that seeks to provide investment exposure to dividend-paying equity securities of global companies operating primarily in the natural resource and commodity-related industries.

1All percentages shown indicate total return of the sector for the month.

THIS MATERIAL MUST BE PROCEDED OR ACCOMPANIED BY A FUND PROSPECTUS. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. You could lose money by investing in the Fund. There can be no assurance that the Fund's investment objectives will be achieved. Because the Fund is non-diversified and can invest a greater portion of its assets in securities of individual issuers than a diversified fund, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund. Diversification does not assure a profit or protect against a loss in a declining market. The Fund is subject to the risks associated with companies in the natural resources and commodities-related industries, energy and material sectors which can cause volatility and affect its value. These industries can be significantly affected by rapid changes in supply and demand, changes in interest rates, government policies and regulations, environmental concerns, worldwide politics, and economic conditions. The Fund will invest in American Depositary Receipts which may be subject to certain risks associated with direct investments in the securities of non-U.S. companies, such as currency, political, economic and market risks because their values depend on the performance of the non-dollar denominated underlying non-U.S. securities. Dividend-Paying Companies are not obligated to pay or continue to pay dividends on their securities. Therefore, there is a possibility that a company could reduce or eliminate the payment of dividends in the future, which could negatively affect the Fund's performance.

Amplify Investments LLC serves as the Investment Adviser to the Fund, and Toroso Investments, LLC serves as the investment sub-adviser.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.