BLOK-Chain Monthly Commentary February 2023

THE MANDATE

The Amplify Transformational Data Sharing ETF (BLOK) is an actively managed fund, seeking to identify the leading companies focused on the transformation and development of the blockchain and cryptocurrency markets. The managers focus on how companies can capture the growth, innovation, and disruption of the blockchain paradigm shift. The evolution of the internet has changed how people communicate. We believe growth companies that embrace blockchain evolution will capture secular growth trends that are accelerating and disrupting core processes in business. We think this is an important secular trend, as Gartner forecasts business value generated by the blockchain could be $176 billion by 2025, and $3.1 trillion by 2030.

JANUARY MONTHLY

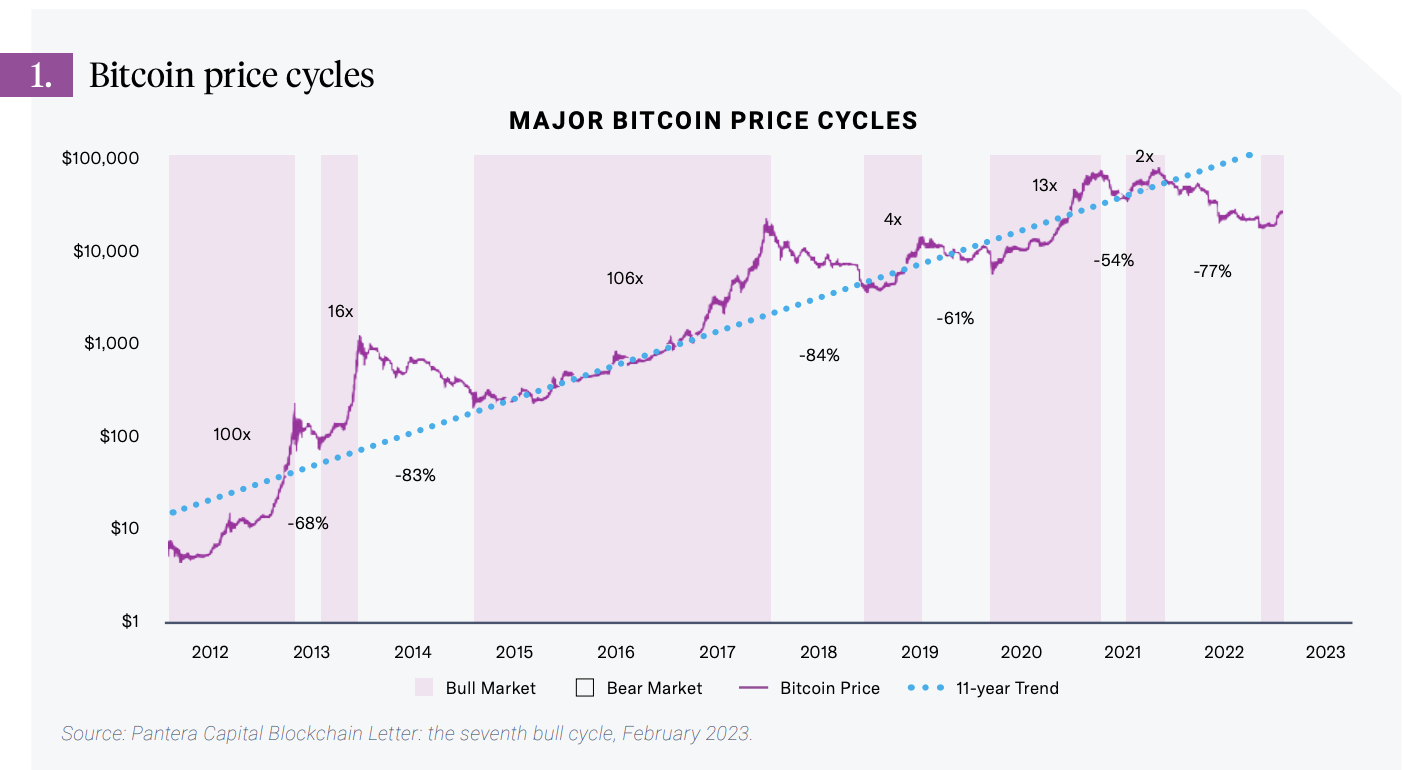

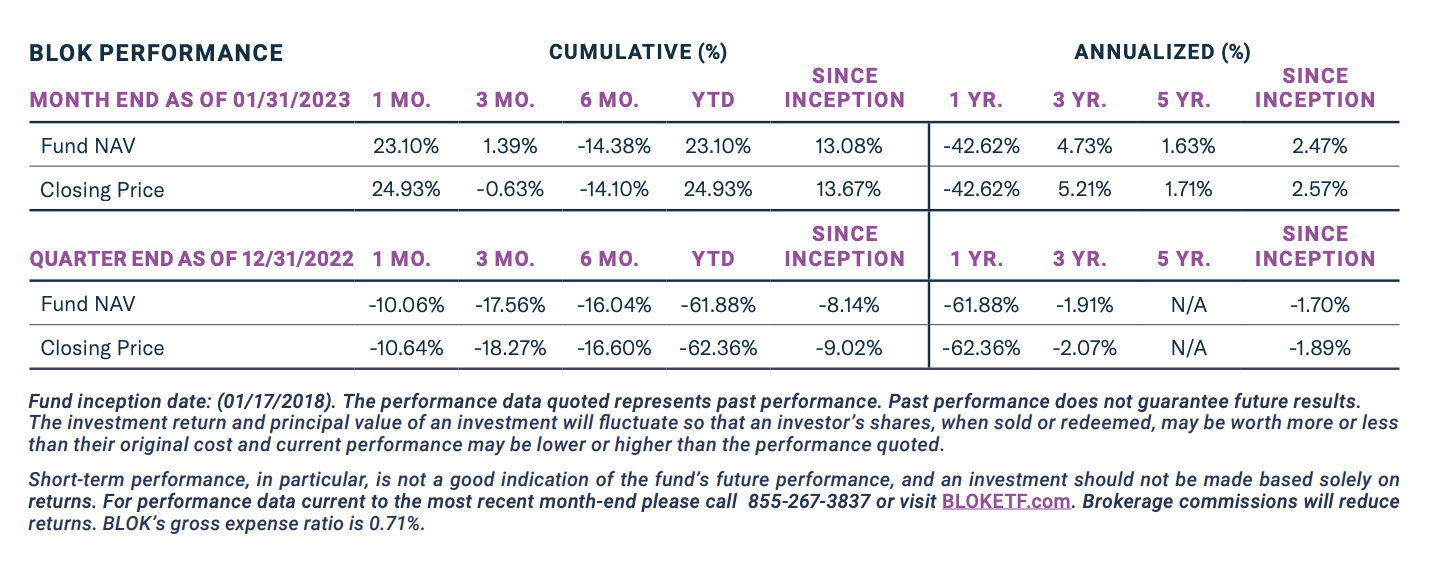

The Fund was up 23.10% in the month of January. This follows extremely oversold conditions from what felt like a state of capitulation, which could signify a new bull market. Evidence of this thesis came as Genesis sadly filed for bankruptcy on January 20th while the price action for digital assets continued to rally, with Bitcoin running to $23,000 (see Figure 1).

The optimism behind the broad market rally saw real buying, with stocks correlated to Bitcoin price moving significantly. For example, positions in MicroStrategy contributed 3%, the 5 bitcoin mining stocks contributed 7.67%, and Coinbase contributed 2.29%. Most importantly, what we saw even into February was an increase in capital markets activity, announced mergers, and a trading volume spike in the space.

■ Coinbase reported that trading volume in January spiked to $55 billion, a 58% increase from December 2022 ($35 billion). Average daily volumes in January ($1.8 billion) are now at the highest levels since August 2022 ($1.9 billion). Peak levels were $3.4 billion in the first quarter of 2022.

■ Bitcoin Miners: Marathon signed a joint venture deal to build a 250 MW facility. HUT8 announces a merge of equals with US Bitcoin to form a $900 million enterprise. Bitfarms restructures its balance sheet by buying back a significant chunk of debt at 40 cents on the dollar.

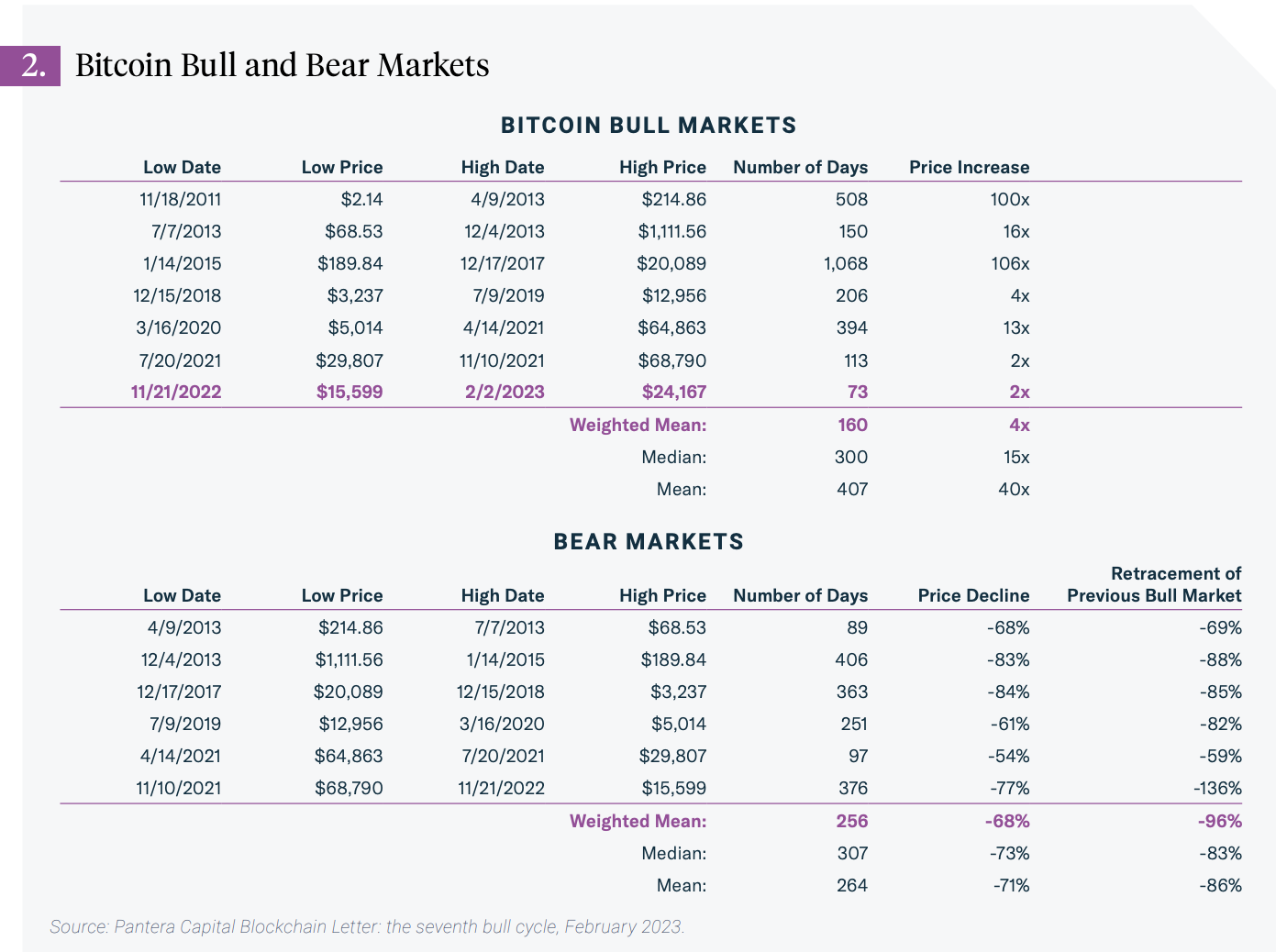

■ It would be reasonable to assume that companies with direct At The Market Offerings (ATM) are raising capital to take advantage of low equipment mining prices. Riot Platforms, for example, has continued to be aggressive in its buildout strategy. This can make for volatility for investors, but as suggested by venture capitalist Pantera, if the price trend for Bitcoin is, in fact exponentially positive, we could be in store for big moves (see Figure 2)

– “The decline from November 2021 to November 2022 was the median of the typical cycle. This is the only bear market to more than completely wipe out the previous bull market.

– The market, in this case, giving back 136% of the previous rally. The median downdraft has been 307 days and the previous bear market was 376. The median drawdown has been a -73% downdraft and the latest bear market ended at -77%.”

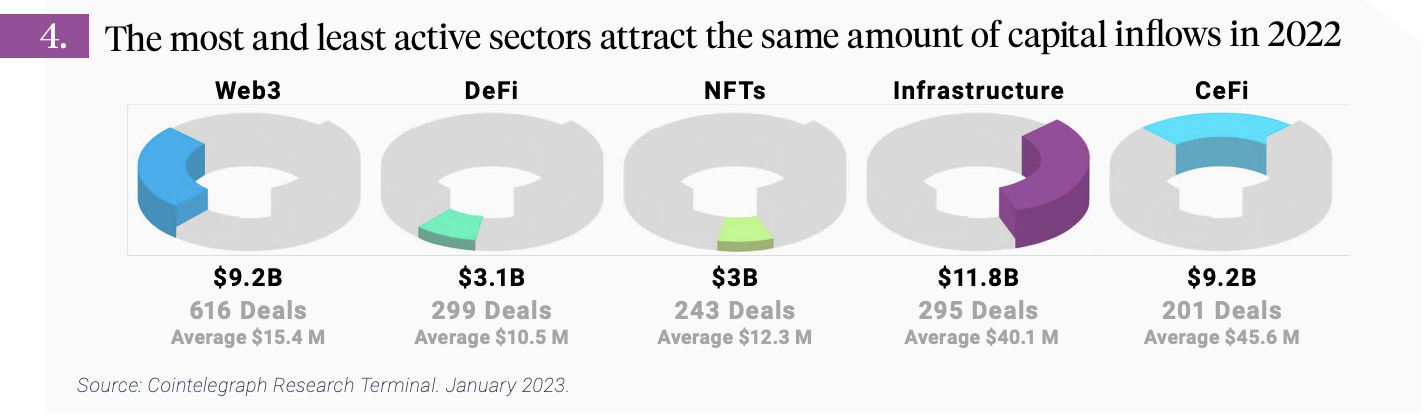

While we referenced Pantera’s views in this report, the holdings in BLOK do not emphasize crypto directly, nor do we hold directly a portfolio of venture capital companies. In fact, current Bitcoin exposure directly aggregates only 9%, and is only expressed through MicroStrategy at 5.41% and the 3 Bitcoin ETFs. Regardless, we have historically had a high correlation to the price action of bitcoin, and view the venture capital category as a critical driver of blockchain development, both directly and indirectly. Flows into the space, both in terms of fiat being directly invested as well as the traditional sources of capital, are important to the revolution. Nevertheless, we would say that while the fourth quarter showed a significant decline in fund flows and comparison in Q1 2023 may look weak, we are optimistic that venture capital pools were not fully invested. Moreover, we were told that in December, the strategy of many CEOs was to extend capital more reasonably.

Three investments make up the Venture portfolio; Overstock (OSTK), Galaxy Digital (GLXY/BRPHF), and SBI Holdings. Galaxy Digital, an investment banker, broad asset manager and venture capitalist, has many levers to pull in the blockchain and crypto space. While we would expect the asset base to be volatile with the crypto markets, it was healthy to see that the asset base rebounded at the end of January to slightly over $2 billion, back to levels seen in August-July 2022. SBI Holdings is a major Japanese financial service with interests across banking, venture capital, trading and crypto mining. SBI provides the portfolio with a solid collection of financial service solutions focused on the Asian markets. Overstock is most known as a $2 billion competitor to Amazon and Wayfair, selling home furnishings with a supply chain strategy that operates on very thin margins. Analysts who cover the stock give zero credit to the Blockchain venture portfolio, so at $900 million in market value, the company trades with $400 million in cash and a portfolio of early stage venture blockchain companies potentially worth a range in aggregate of $300 million to $1 billion. Management is focused on the retail business and has outsourced the venture capital portfolio, named Medici Ventures, to Pelion Ventures who specializes in the Blockchain area. It is difficult to know how this asset will play out. We expect certain Medici portfolio holdings (about 20 investments) such as tZero, Bitt and Grainchain to demonstrate evidence of real advancement as blockchain solutions in 2023. Evidence will come in the form of relationships, joint ventures and capital raises which confirm valuations and progress.

JANUARY PORTFOLIO TRANSACTIONS

In January, we made some targeted portfolio decisions by increasing positions in platform companies NU Holdings, PayPal (PYPL) and the bitcoin miners (MARA, HUT8, HIVE, BITF). We did not increase RIOT because we had made that decision in December. We trimmed positions further in International Business Machines (IBM), Walmart (WMT) and sold out completely from Intel (INTC) and Signature Bank\New York (SBNY). As the world now knows, Intel is again in transition mode. The position we hold in HIVE, through the commercialization of the Intel chip in the Buzzminer9, provides more direct exposure. The decision to sell SBNY was triggered by their decision to limit their crypto deposit exposure to 20% and only deal with crypto transactions with a minimum of $100,000. The SPAC holding, Nocturne (MBTCU), was sold upon the announcement that it had plans to consummate a non-blockchain deal. This had been categorized in the venture category of the portfolio, but with the de-spacing process not meeting our original agenda it made sense for us to cash out. Note, to be clear, markets have changed since we originally made the investment so this is a positive outcome.

EDUCATION

For those who just want to get educated on the Blockchain, here are some links:

■ Fidelity: Bitcoin First https://www.fidelitydigitalassets.com/research-and-insights/bitcoin-first

■ CoinDesk: For those looking for live coverage: https://www.coindesk.com/

■ Satoshi Nakamoto Original Bitcoin White paper: Bitcoin: A Peer-to-Peer Electronic Cash System https://bitcoin.org/bitcoin.pdf

SUMMARY

January 2023 was a strong month for BLOK, with price appreciation of 23.10%. This performance follows a January rebound in Bitcoin which had a direct effect on the mining companies that are core investments in the Fund. In addition, the substantial rally in shares of Coinbase and MicroStrategy reflected rational moves that were both correlated by their asset bases and increased trading activity in crypto. It is noteworthy that in December and January we also made some strategic changes to the portfolio to increase the correlation to such price action. We are optimistic that Bitcoin has now formed a bottom, and even more excited about the developments we are seeing in Blockchain. Again, while the price action of digital assets makes for the headline in a ubiquitous manner, the actual behind scenes action around Blockchain continues to be quietly even more convincing to those who are paying attention to the use case.

Thank you for your interest and confidence in our ability to navigate these difficult times.

Disclosure

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by calling 855-267-3837, or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Click HERE for BLOK’s top 10 holdings.

Click HERE for BLOK’s prospectus.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. The Fund’s return may not match or achieve a high degree of correlation with the return of the underlying index.

The Fund is subject to management risk because it is actively managed. Narrowly focused investments typically exhibit higher volatility. A portfolio concentrated in a single industry, such as companies actively engaged in blockchain technology, makes it vulnerable to factors affecting the companies. The Fund may face more risks than if it were diversified broadly over numerous industries or sectors. Blockchain technology may never develop optimized transactional processes that lead to realized economic returns for any company in which the Fund invests.

The Fund invests at least 80% of the Fund’s net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies. Such investments may be subject to the following risks: the technology is new and many of its uses may be untested; theft, loss or destruction; competing platforms and technologies; cybersecurity incidents; developmental risk; lack of liquid markets; possible manipulation of blockchain-based assets; lack of regulation; third party product defects or vulnerabilities; reliance on the Internet; and line of business risk. The investable universe may include companies that partner with or invest in other companies that are engaged in transformational data sharing or companies that participate in blockchain industry consortiums. The Fund will invest in the securities of foreign companies. Securities issued by foreign companies present risks beyond those of securities of U.S. issuers.

The Fund may have exposure to cryptocurrencies such as bitcoin indirectly through investment funds, including through an investment in the Bitcoin Investment Trust ("GBTC"), a privately offered, open-end investment vehicle. Even when held indirectly, investment vehicles like GBTC may be affected by the high volatility associated with cryptocurrency exposure. Holding privately offered investment vehicle in its portfolio may cause the Fund to trade at a premium or discount to NAV. Many significant aspects of the U.S. federal income tax treatment of investments in cryptocurrencies are uncertain and such investments, even indirectly, may produce non-qualifying in- come for purposes of the favorable U.S. federal income tax treatment generally accorded to regulated investment companies.

Amplify Investments LLC is the Investment Adviser to the Fund, and Toroso Investments, LLC serves as the Investment Sub-Adviser.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.