BLOK-Chain Monthly June 2025

Full Circle: TradFi Loves DeFi

The Fund’s NAV return in May 2025 was up 20.16% following a strong April (see standardized performance). As of May 31, YTD the Fund was up 12.07%. Moreover, as much as these numbers should impress, we believe that the capital flows into Bitcoin and platforms like the IPO (Initial Public Offering) for Circle Internet Group (CRCL) prove that the asset class is getting re-rated. With billions of investment dollars now pouring into the asset category through the IPO market, Special Purpose Acquisition Company (SPACs) and other non-traditional means, we see adoption re-accelerating to fund the transformation of industries. This is why we have titled this piece “Full Circle: TradFi Loves DeFi!”

Inquiring minds who read this report on a regular basis may be wondering about our thoughts on Circle Internet Group (CRCL). For the record, we like the Company and were optimistic about an allocation in the IPO. We also tried to buy the stock at levels where we felt “a starting position” made sense relative to the IPO price and relative to the other disruptive platform companies in the digital asset category. To this point, we would highlight that a majority (about 60%) of the economics earned through the stablecoin business currently goes to Coinbase (COIN). For those selling out of COIN to buy CRCL, we also want to point out that COIN may have real free cash flow in 2025 and 2026. Some of this may come from the partnership they have with Circle. We point to this because many have asked us why 2024 was such a pivotal year. Stay tuned and buckle up for 2025!

May Updates

May had a number of highlights and funding announcements, but Bitcoin 2025 was the largest and most upbeat conference we have ever attended.

Bitcoin 2025: There were over 32,021 in attendance and the lineup of presenters included: the Vice President of the United States, J.D. Vance, White House AI & Crypto Czar, David Sacks, as well as Senator Cynthia Lummis and several corporate leaders such as: Michael Saylor (MSTR), Jack Maller (CEP) and Simon Gerovich (3350 JP/MTPLP). We even had the opportunity to spend time with Donald Trump Jr., Eric Trump and Cameron and Tyler Winklevoss. However, more than just enjoying the optimism of the moment we heard great clarity around the near-term regulatory environment which included:

1. Stablecoin legislation that could possibly go into effect in August.

2. Strategy from David Sacks on how the US. already has a legal path to acquire additional BTC if done in a budget neutral manner via President Trump’s Executive Order (EO).

3. Not to be outdone, of course, was Senator Lummis speech to move forward the Bitcoin Act which proposes to own 1 million BTC or about 5% of the outstanding BTC over the next 5 years in a U.S. Strategic Bitcoin Reserve (SBR).

States - Strategic Bitcoin Reserve (SBR) Progress: Besides, the comments about U.S. SBR at Bitcoin 2025, it should not be overlooked that New Hampshire and Arizona both approved plans for SBRs in May. Texas also made progress with its passing of a Bitcoin Reserve Bill which is expected to be signed by the Governor in June. However, not every politician is in agreement with this effort. The Governor of North Carolina vetoed the SBR bill that was presented. We still see this as progress and feel for our friends and family in North Carolina.

Stablecoin Legislation: The Senate passage of the GENIUS Act on May 21st also was a significant step forward in May. There will undoubtedly be some twists and turns as the Stable bill moving forward in the House gets consolidated with the "Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025" (GENIUS) bill, but by the end of the summer the President could sign off on it. If passed, we believe the GENIUS Act would help to drive significant incremental adoption of digital assets in the U.S. and expand the total market cap for stablecoins. Growth in U.S.-dollar backed stablecoin adoption may have several positive impacts for the U.S., as increased integration of stablecoins into the payment systems in the U.S. and abroad could reduce 1) costs, 2) transaction settlement times, and 3) counterparty risks for merchants, while also increasing demand for U.S. treasuries as they are used for stablecoin reserves, which would inherently strengthen U.S. dollar dominance. Lawmakers at the conference expressed confidence in the U.S. passing stablecoin and market structure legislation CLARITY Act (Digital Asset Market Clarity Act) before August recess.

Galaxy Digital: We also have to congratulate our friends at Galaxy Digital (GLXY) who officially became a U.S. listed company on the Nasdaq. Getting listed in the U.S was a courageous battle that was won for investors, employees and frankly non-participants who may not even be aware. The challenge to be listed in the U.S. when you are headquartered in the U.S. and employ 70% of your workforce in the U.S. should not be difficult; especially when you are running a legitimate transparent business that is audited by a major accounting firm and……. want to pay taxes. Congrats Galaxy! We remember when you were just a $.50 stock on the Canadian Stock Exchange!

The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For most recent month-end performance, visit BLOKETF.com.

Transactions and Repositing:

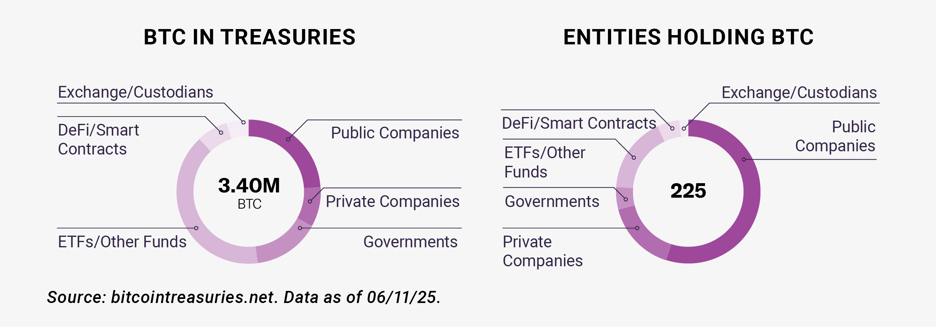

In May we trimmed back our exposure in Strategy (MSTR) and Metaplanet (3350 JP) which contributed significant alpha1 to the portfolio and exceeded our threshold of 5.5% multiple times. These treasury companies remain core holdings in our portfolio, and we admire their focus and leverage to Bitcoin price action, but our risk management process is systematic and aligned with our belief that diversification helps to manage risk. We never know what we don’t know!!! Similarly, with the rally in Robinhood (HOOD) we were forced to trim back and take profits. Fortunately, as an ETF we can shelter these gains. As a diversified Fund we hope to achieve diversified returns so sometimes we will trim one stock whose success has led to an overweight position, and we may replace that exposure with a similar type of holding. To this point, we increased our exposure to GameStop (GME). There are now over 124 companies implementing different types of Bitcoin/Crypto treasury strategies with aggregate Bitcoin holdings balance around 818,000, according to BitcoinTreasury.net.2 Obviously, MSTR with Michael Saylor inventing the strategy is the largest chunk of this balance. We note that the website below is a useful resource in tracking overall ownership in Bitcoin. Again, as a reminder BTC ownership is very transparent and important to the demand/supply equation.

We trimmed back on Riot Platform and Marathon Holdings to take a more targeted approach for which Data Center/Bitcoin miners we are long. As a reminder, we were early investors in both these companies with a dynamic approach to our exposure that dates back to 2018. In May we also increased our position in Blackrock (BLK) and added a new position in WisdomTree. Lastly, Exodus Platform (EXOD) as a new holding at 75 basis points (BPs) was added in May. We would highlight that EXOD has taken a different road to coming to public on Nasdaq and this path included being listed on the tZERO platform. tZero is primarily owned by Beyond (BYON) and the NYSE (ICE).

Attribution:

May was a powerful month with great broad-based momentum. However, seven names made up about 64% of the return. Metaplanet (3350 JP/MTPLF), the standout performer and true to its name, continued to run on rocket fuel, up nearly 175% in May alone. Such a strong performance contributed over 5% of the roughly 20.16% return. Other significant performances came from Beyond (BYON), Galaxy Digital (GLXY), Robinhood (HOOD), Core Scientific (CORZ) and Roblox (RBLX). These stocks were up about 57.49%, 37.65%, 34.69%, 31.48%, and 29.72% and contributed to the fund approximately 1.11%, 1.69%, 1.82%, 1.14%, and 0.88%, respectively.

TOP 10 HOLDINGS (as of 5/31/2025)

Holdings and allocations are subject to change at any time and should not be considered a recommendation to buy or sell a security.

BLOK PERFORMANCE CUMULATIVE (%) ANNUALIZED (%)

Fund Inception Date: 1/17/2018. BLOK’s total expense ratio is 0.73%. The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For most recent month-end performance, visit AmplifyETFs.com/BLOK. Brokerage commissions will reduce returns. NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The closing price is the last price at which the fund traded.

Summary:

With capital markets clearly being open for funding innovation in the digital asset category we see momentum building through the summer. We envision the category exploding with deals, acquisition announcements and partnerships. Our approach will remain dynamic and disciplined around risk management. When we experience volatility, we may not make changes because we like and know what we own, but this does not mean we won’t also be active in realizing tax-free profits within the wrapper. The ETF wrapper offers us that advantage, and we are happy to pass that benefit along to our investors. As a fund, we actively seek disruptive opportunities through diversification. The expansion of our universe of investment opportunities gives us optimism about the potential future of the asset category. More is better! However, we will continue to be vigilant about also trying to manage risk.

Education

For those who just want to get educated about the blockchain, here are some links:

- Podcast: The Empirepod, by Jason Yanowitz with Samara Cohen3

- Article: 2025 Cryptocurrency Adoption and Consumer Sentiment Report | Security.org4

- Article: Blockchain Statistics 2025: Adoption Rate & Usage5

- Satoshi Nakamoto Original Bitcoin White paper: Bitcoin: A Peer-to-Peer Electronic Cash System https://bitcoin.org/bitcoin.pdf

*BPs: A basis point (BP) is a unit that is equal to 1/100th of 1%.

**Schedule K-1 is a federal tax document used to report the income, losses, and dividends of a business’ or financial entity’s partners or an S corporation’s shareholders. This information does not constitute, and should not be considered a substitute for, legal or tax advice.

1Alpha is a measure of an investment's performance that indicates its ability to generate returns in excess of its benchmark.

2bitcointreasuries.net/

3x.com/theempirepod/status/1916869992181645656

4security.org/digital-security/cryptocurrency-annual-consumer-report/

5demandsage.com/blockchain-statistics/

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.