DIVO Commentary February 2024

COMMENTARY

The major equity market indices continued to make new all-time highs during the month of February, but it was no longer the “Magnificent 7” driving all the gains. Certainly a few of them helped but resilient economic data and relatively better-than-expected earnings helped give investors additional confidence to broadly push equities higher. Positive economic data has become a precarious thing; on one hand it’s supportive for a healthy economy but on the other, the strength has investors wondering if will give the Fed confidence to keep interest rates higher for longer. Fixed income, which had done tremendously well since late 2023, sold off slightly during February as investors’ expectations for rate cuts moved further out.

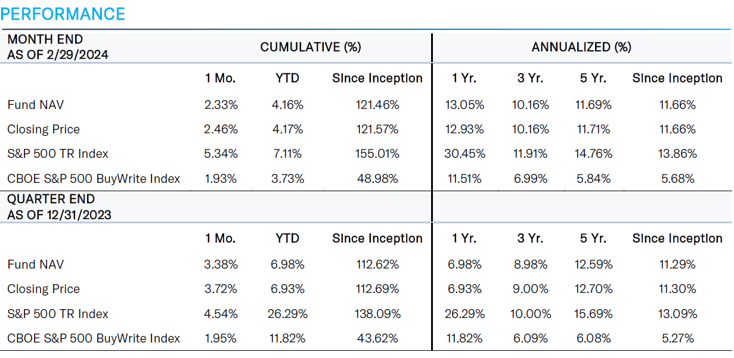

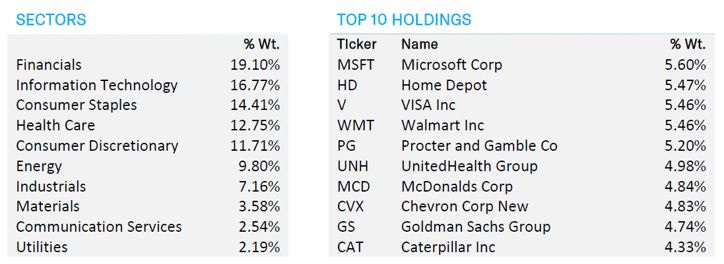

During February, the Amplify CWP Enhanced Dividend Income ETF (DIVO) returned 2.33% while the benchmark, the S&P 500 TR Index, returned 5.34% and the CBOE S&P 500 BuyWrite Index returned 1.93%. The Financials sector (+4.59%) contributed most significantly to the Fund’s return for the month along with Information Technology (+3.08%) and Consumer Discretionary (+4.21%).1 Communication Services (-5.50%) contributed the least to the return during the period followed by Materials (-3.64%). Positions that contributed most significantly included Caterpillar (CAT), Home Depot (HD) and Walmart (WMT). Positions that detracted most from returns in February included UnitedHealth (UNH) and Verizon (VZ).

The Fund did not add any new positions during February but was active in adding to and trimming from existing positions. Cisco (CSCO) and JP Morgan (JPM) were added to after being partially called away at expiration mid-month. CME Group (CME) and Marathon Petroleum (MPC) were added to while reducing some exposure to Deere (DE) after it had a strong run.

From an options standpoint, we were active and tried to capture premium as volatility picked up periodically throughout the month. We sold new calls during the month on Apple (AAPL), Caterpillar (CAT), Cisco (CSCO), Goldman Sachs (GS), Marathon Petroleum (MPC), Merck (MRK), Microsoft (MSFT), Procter & Gamble (PG), Visa (V) and Walmart (WMT). While most of those calls expired during the month, we were partially called away on Cisco (CSCO) and JP Morgan (JPM).

The portfolio held a total of three covered calls2 at the end of February 2024: Microsoft (MSFT), Procter & Gamble (PG) and Visa (V). At the end of the month, approximately 2.1% of the portfolio was covered.

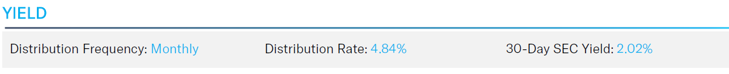

YIELD

Distribution Rate is computed as the normalized current distribution (annualized) over NAV per share. In addition to net interest income, distributions may include capital gains and return of capital (ROC). Please click here for more information. 30-Day SEC Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows for fairer comparisons among bond funds. It is based on the most recent month end. This figure reflects the income earned from dividends – excluding option income – during the period after deducting the Fund’s expenses for the period.

PERFORMANCE

Fund inception date: 12/14/2026. DIVO's gross expense ratio is 0.55%.The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Short-term performance, in particular, is not good indication of the fund's future performance, and an investment should not be made based solely on returns. For performance data current to the most recent month-end please visit AmplifyETFs.com/DIVO. Brokerage commissions will reduce returns. A fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The closing price or market price is the most recent price at which the fund was traded.

All data as of 2/29/2024. Subject to change at any time. Fund holdings should not be considered recommendations to buy or sell any security. View Current Complete Holdings.

Index Definitions: All indexes are unmanaged and it's not possible to invest in an index. S&P 500 Total Return Index — market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value, and assumes distributions are reinvested back into the index. It does not include fees or expenses. CBOE S&P 500 BuyWrite Index (BXM)—tracks the performance of a hypothetical buy-write strategy on the S&P 500 Index. A “buy-write” strategy is generally one in which an investor buys a stock (or basket of stocks), and also writes covered calls that correspond to those holdings.

DIVO differs substantially from the S&P 500 Index and CBOE S&P 500 BuyWrite index, which are used for comparison purposes as widely recognized measures of U.S. stock market performance. While the returns of DIVO have exhibited positive (but varying) correlation to the indexes over time, DIVO may invest in different stocks and in different proportions than in the S&P 500 index and CBOE S&P 500 BuyWrite index.

1All percentages shown indicate total return of the sector for the month.

2A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security.

THIS MATERIAL MUST BE PROCEDED OR ACCOMPANIED BY A FUND PROSPECTUS. Read the prospectus carefully before investing.

© 2023 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.