DIVO Commentary March 2024

COMMENTARY

Another month and another new all-time high for the equity markets as measured by the S&P 500 and Nasdaq 100. While the spotlight predominantly fell on the "Magnificent 7" as the calendar ushered in 2024, a quiet transformation was happening beneath the surface. Market breadth is no longer just concentrated in 7 high flying stocks as indices like the Equal Weight S&P 500 and S&P 400 Mid Cap finally surpassed previous highs set in 2021. Even though inflation, the Fed, elections, and geopolitical tensions continue to be closely watched by investors, the equity market has continued to take it in stride.

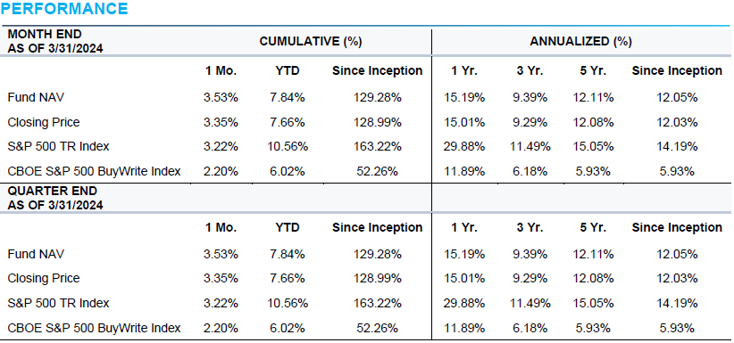

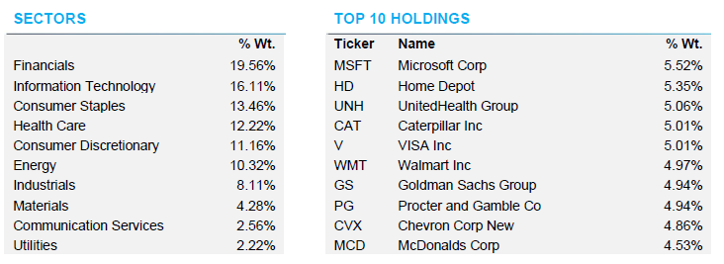

During March, the Amplify CWP Enhanced Dividend Income ETF (DIVO) returned 3.53% while the benchmark, the S&P 500 TR Index, returned 3.22% and the CBOE S&P 500 BuyWrite Index returned 2.20%. The Energy sector (+9.28%) contributed most significantly to the Fund’s return for the month along with Materials (+24.32%) and Industrials (+10.71%).1 Consumer Discretionary (-0.93%) contributed the least to the return during the period followed by Health Care (+0.85%). Positions that contributed most significantly included Freeport McMoRan (FCX), Caterpillar (CAT) and Marathon Petroleum (MPC). Positions that detracted most from returns in March included Johnson & Johnson (JNJ) and McDonalds (MCD).

The Fund added one new position during the month, rotating some of the exposure in the Health Care sector. Amgen (AMGN) was added during March while Johnson & Johnson (JNJ) was removed after underperforming for several months. Amgen has an attractive yield and history of dividend growth, in addition to a shareholder friend buyback program and robust pipeline of pharmaceutical drugs in various stages of development. Several existing positions were added to during March including UnitedHealth (UNH), JPMorgan (JPM) and Caterpillar (CAT) while the position in Broadcom (AVGO) was trimmed after a strong run.

From an options standpoint new calls during the month were sold on Agnico Eagle Mines (AEM), Chevron (CVX), Duke Energy (DUK), Marathon Petroleum (MPC), McDonalds (MCD), Visa (V) and Walmart (WMT).

The portfolio held a total of six covered calls2 at the end of March 2024: Agnico Eagle Mines (AEM), Chevron (CVX), Duke Energy (DUK), McDonalds (MCD), Visa (V) and Walmart (WMT). At the end of the month, approximately 19.3% of the portfolio was covered.

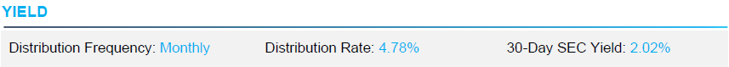

Distribution Rate is computed as the normalized current distribution (annualized) over NAV per share. In addition to net interest income, distributions may include capital gains and return of capital (ROC). Please click here for more information. 30-Day SEC Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows for fairer comparisons among bond funds. It is based on the most recent month end. This figure reflects the income earned from dividends – excluding option income – during the period after deducting the Fund’s expenses for the period.

PERFORMANCE

Fund inception date: 12/14/2026. DIVO's gross expense ratio is 0.56%.The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Short-term performance, in particular, is not good indication of the fund's future performance, and an investment should not be made based solely on returns. For performance data current to the most recent month-end please visit AmplifyETFs.com/DIVO. Brokerage commissions will reduce returns. A fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The closing price or market price is the most recent price at which the fund was traded.

All data as of 3/31/2024. Subject to change at any time. Fund holdings should not be considered recommendations to buy or sell any security. View Current Complete Holdings.

Index Definitions: All indexes are unmanaged and it's not possible to invest in an index. S&P 500 Total Return Index — market-capitalization-weighted index of the 500 largest U.S. publicly traded companies by market value, and assumes distributions are reinvested back into the index. It does not include fees or expenses. CBOE S&P 500 BuyWrite Index (BXM)—tracks the performance of a hypothetical buy-write strategy on the S&P 500 Index. A “buy-write” strategy is generally one in which an investor buys a stock (or basket of stocks), and also writes covered calls that correspond to those holdings.

DIVO differs substantially from the S&P 500 Index and CBOE S&P 500 BuyWrite index, which are used for comparison purposes as widely recognized measures of U.S. stock market performance. While the returns of DIVO have exhibited positive (but varying) correlation to the indexes over time, DIVO may invest in different stocks and in different proportions than in the S&P 500 index and CBOE S&P 500 BuyWrite index.

1All percentages shown indicate total return of the sector for the month.

2A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security.

THIS MATERIAL MUST BE PROCEDED OR ACCOMPANIED BY A FUND PROSPECTUS. Read the prospectus carefully before investing.

© 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.