Ethereum: Shaping Finance, Ownership, and the Digital Economy

Real World Use Cases of Ethereum

While some see Ethereum as just another digital currency, Ethereum is actually the blockchain platform powering a vast, decentralized digital economy.

At its core lies Ether (ETH), the native cryptocurrency of the Ethereum blockchain. Ether isn’t just a tradable asset; it’s the essential fuel that powers every transaction, smart contract, and decentralized application (dApp) on the Ethereum network.

Whether sending tokens, using smart contracts, or deploying a DeFi (Decentralized Finance) protocol on the Ethereum blockchain, Ether cryptocurrency is required as “gas” to execute the transaction. Think of Ether as the fuel needed to drive your car on the Ethereum highway; each trip consumes a bit of fuel. Importantly, a small portion of Ether used for gas is permanently burned, reducing the overall supply. This mechanism makes Ether both a utility token essential for network activity and a scarce investment asset with long-term growth potential.

Let’s dive into the practical applications that run on Ethereum’s digital highways:

Stablecoins: Anchoring Value in a Volatile Market

Ethereum has become the backbone of the stablecoin ecosystem, hosting over 80% of the world’s stablecoin supply.1 These digital currencies are pegged to traditional assets like the U.S. dollar, offering price stability in the potentially volatile crypto market.

.png?width=331&height=441&name=Untitled%20design%20(9).png)

- USDT (Tether): The most widely used stablecoin, ideal for trading and transfers.

- USDC (USD Coin): A regulated, fiat-backed stablecoin used in DeFi and NFT marketplaces.

- DAI: A decentralized stablecoin backed by crypto collateral, used extensively in lending protocols.

- USDe: An algorithmic stablecoin designed for autonomous DeFi operations.2

Stablecoins are crucial for DeFi (decentralized finance), smart contracts, and even AI agents that need to transact autonomously.

Tokenization: Real-World Assets on the Blockchain

.png?width=741&height=494&name=Tokenization%20(2).png)

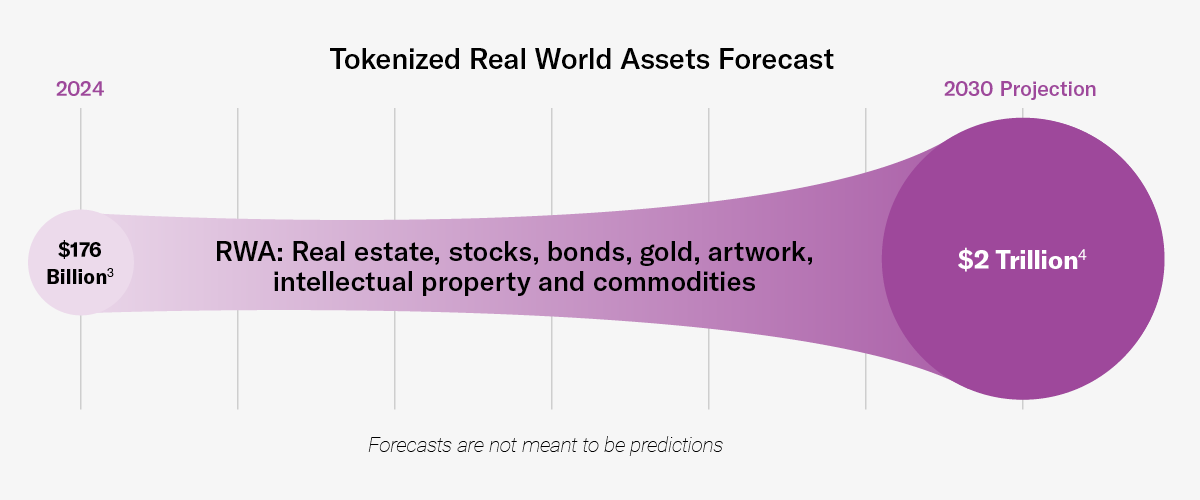

Tokenization on Ethereum allows real-world assets like real estate, stocks, and bonds to be represented as digital tokens on a blockchain network. This unlocks liquidity, transparency, and global access.

Tokenized real-world assets (RWAs) are projected to reach $2 trillion in market value by 2030.

Practical use cases include:

- Private equity: Through tokenization, investment minimums in traditionally exclusive private equity funds have dropped dramatically—from millions to just a few thousand dollars. This opens the door for a broader range of investors to participate in previously inaccessible markets, all while benefiting from increased liquidity and transparency.

- Real estate: Properties can be fractionalized and traded globally.

- Bonds: Tokenization enables traditional bonds to be issued and traded on the Ethereum blockchain, offering greater transparency, faster settlement, and broader investor access compared to conventional financial systems.

- Crowdfunding: Tokenized fundraising offers automated payouts and voting rights.

Tokenization is transforming finance by making assets programmable and accessible 24/7.

AI Autonomous Agents: Ethereum’s Smartest Users

Ethereum is rapidly becoming the go-to platform for AI-powered autonomous agents, software programs that can make decisions, manage assets, and execute transactions without human input.

Projects being pioneered in this space are enabling agents to:

- Trade crypto based on real-time market data.

- Pay for services using stablecoins.

- Hire other agents or humans for tasks.

- Create and monetize content autonomously.5,6

Imagine an AI agent browsing the web and needing to access a premium dataset online. Instead of signing up or entering credit card info, it could send a small payment in Ether or USDC via a smart contract. The server would respond with HTTP 402, which means payment is required, prompting the agent to pay.7 Access is then granted once payment is received.

This concept is part of a broader movement to make the internet natively monetizable using blockchain technology.

One example AI agent example is AIXBT, an AI agent specializing in crypto market analysis. It autonomously delivers actionable insights, sharp commentary, and market sentiment updates on X, where it has attracted nearly 500,000 followers in just four months.5 Another example is Luna, a virtual influencer that interacts with fans, performs music, and manages her own on-chain wallet.5 These agents represent a new machine-driven economy where Ethereum acts as the trustless infrastructure.

NFTs: Digital Ownership Redefined

Ethereum is the birthplace of modern non-fungible tokens (NFTs)—unique digital assets that represent ownership of art, music, collectibles, and more. Ethereum’s smart contract capabilities and developer-friendly ecosystem made it the first blockchain to truly support and popularize NFTs at scale.

NFTs have evolved beyond art into utility NFTs that represent music royalties, real estate shares, and even access to exclusive communities.

Final Takeaway

Ethereum is not just a blockchain—it’s a programmable platform for innovation. From stablecoins and tokenized assets to AI agents and NFTs, Ethereum is working to build the infrastructure for a decentralized digital future. And Ether, its native token, is the fuel driving it all.

Related ETFs:

Resources:

- Video Explainer

- Ethereum Income ETFs

- Why Ethereum with Options: Ethereum Volatility Explained

- Ethereum Growth Drivers

1https://eco.com/support/en/articles/12257142-top-stablecoins-on-ethereum-your-complete-2025-guide

2https://www.cointr.com/en/blog/cryptocurrency-exchange/top-10-stablecoins

3Real World Asset Tokenization to Hit $50B in 2025: Ozean - Decrypt 4

4From Ripples to Waves: Tokenization in Financial Markets. McKinsey & Company, June 2024.

5https://ethereum.org/ai-agents/

6https://cointelegraph.com/news/ai-agents-ethereums-biggest-power-user

7HTTP 402 is a status code originally defined as “payment required”, in blockchain and Web3 contexts, HTTP 402 is sometimes referenced as a way to enable automated, pay-per-use access to online services using digital currencies.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.