Fed Leadership and Policy Shifts: Preparing for What’s Ahead

Market and Economic Update - Potential Impacts of Lower Interest Rates

The Federal Reserve (also called the Fed) plays an important role in the U.S. economy and financial system. In May 2026, Jerome Powell’s time as Fed Chair will end. This means the President will choose a new leader for the Fed. This change could affect interest rates, the stock market, and your investments.

Many people focus on what the Fed will do next with interest rates. But there’s also debate about what the Fed’s job should be. The Fed’s role has changed over time. Some people think the Fed should do more, while others think it should do less. These disagreements affect what policies the Fed chooses today.

Understanding these topics matters because they shape both current decisions and the future of the Fed. What should investors know as Fed news fills the headlines?

1. New Leadership In 2026 Could Change Fed Policy

Since Jerome Powell's term as Fed Chair ends soon the President is expected to name a replacement early in 2026. Right now, the top candidates include Kevin Warsh (a former Fed governor) and Kevin Hassett (Director of the National Economic Council). However, this could change.

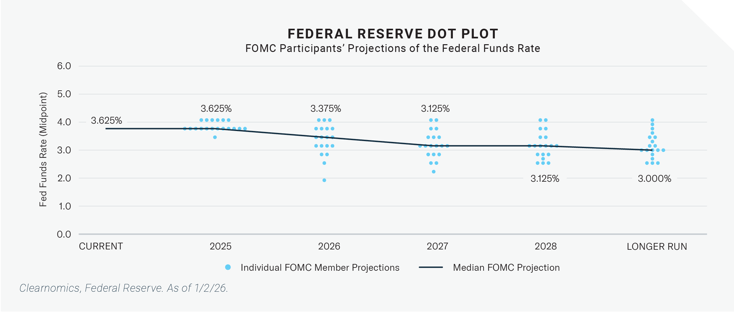

The chart above shows the Fed’s latest economic forecasts. These suggest the Fed may cut rates only once in 2026 and once in 2027. Conversely, the new Fed Chair will likely favor keeping rates lower, so these forecasts may change.

It’s important not to overreact to these potential changes. The Fed Chair is influential but doesn’t make decisions alone. The committee includes twelve voting members with different views. The Fed tries to reach agreement among members, so even a new Chair must convince others.

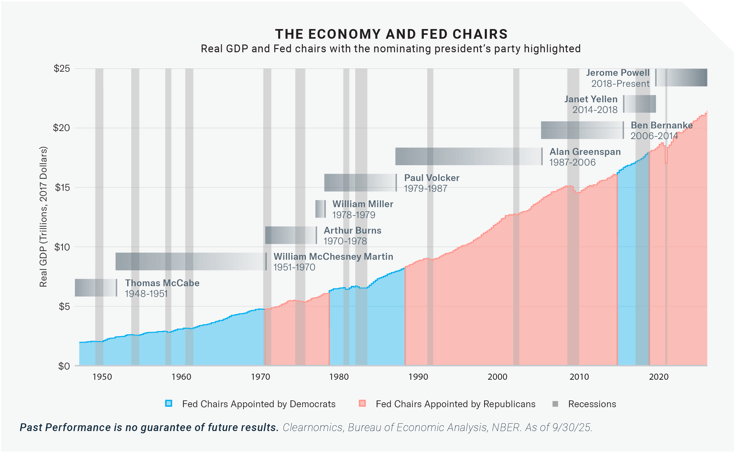

The economy has grown steadily under different Fed Chairs from both political parties. Jerome Powell was actually nominated by President Trump in his first term and stayed on during President Biden’s term. Fed policy fitting the current economic conditions and the leader of the Fed are both important.

|

|

2. Potential Impacts Of Lower Rates

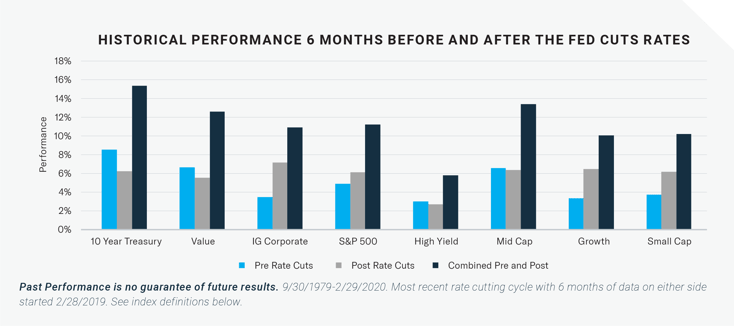

Lower interest rates ripple through financial markets in several ways:

- Bond Prices

These typically rise because their fixed payments look more attractive compared to new, lower-yield bonds. - Stocks

The stock market may benefit too, as cheaper borrowing costs can boost corporate profits and make equities more appealing than low-yield alternatives. - Currencies

At the same time, currencies may weaken when rates fall, which can help exporters but also raise the cost of imports. The dollar weakening could also heighten interest in store of value assets like precious metals or even cryptocurrencies which are often used as a hedge against currency depreciation. - Cryptocurrencies

An accommodative monetary policy and increased liquidity may create a tailwind for cryptocurrencies by driving more capital toward these types of assets. Additionally, crypto markets sometimes move in tandem with tech stocks and other growth-oriented assets, which may benefit from improved liquidity. - Consumers and Businesses

Lower rates mean cheaper loans and mortgages, encouraging spending and investment. This can stimulate economic growth, but it also reduces returns in high yield savings accounts. It may be a headwind for conservative income-oriented investors and they may want to reconsider portfolio allocations. Businesses often take advantage of lower financing costs to expand, though easy credit can lead to higher debt levels.

|

|

Overall, while lower rates can energize the economy, they come with trade-offs to keep in mind.

3. The Fed Does More Today Than When It Started

Congress created the Federal Reserve in 1913. The Fed is not part of the government, and the Constitution didn’t create it. This raises some questions: the Fed’s job has grown a lot over time, Fed officials aren’t elected by voters, and politicians often want lower interest rates to help the economy grow.

When the Fed started, its main job was to stop bank panics. In the 1800s and early 1900s, these panics happened often and hurt businesses and regular people. During a bank panic, people rush to take their money out of banks because they’re worried. This can cause big problems for banks and the whole financial system.

These types of crises are less common now. The Fed makes sure banks have enough money in reserve. The Fed also acts as a backup lender when banks need help. Just knowing the Fed is there helps keep the financial system stable.

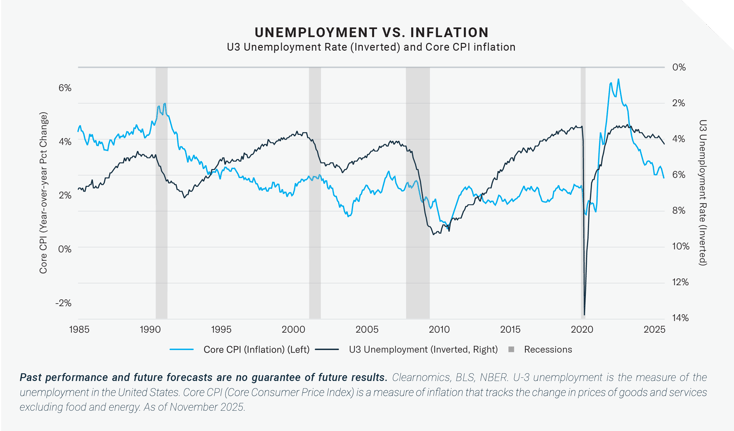

Over time, the Fed’s job has expanded. In 1977, Congress told the Fed to work toward “maximum employment, stable prices, and moderate long-term interest rates.” The Fed usually focuses on the first two goals, called its “dual mandate.”

This means the Fed now manages not just banks and the dollar, but tries to manage the broader economy. This is why people pay so much attention to the Fed’s interest rate decisions.

While there will be many headlines about Fed leadership and responsibilities, the health over the overall economy is important. The next Fed Chair may prefer lower interest rates, but this depends on the job market and inflation. It is key to have a plan that matches your financial goals rather than react to daily Fed speculation.

4. Fed Independence Has Pros And Cons

The President appoints Fed officials and Congress approves them, but voters don’t elect them directly. Some people say the Fed has too much power for an unelected group. Others say the Fed needs to make unpopular choices that hurt in the short term but help in the long term. Both arguments have merit.

A good example is the 1970s and early 1980s. During that time, the U.S. had high inflation and high unemployment at the same time. Fed Chair Paul Volcker raised interest rates sharply. This caused a recession but eventually the inflation problem improved.

The Fed doesn’t always make perfect decisions. Former Fed Chair Ben Bernanke admitted the Fed made mistakes during the Great Depression. More recently, many people thought the Fed was too slow to fight inflation after the pandemic in 2021.

The Fed’s main tool is controlling short-term interest rates. This is called a “blunt instrument” because one interest rate can’t fix all economic problems. The Fed can’t directly solve supply chain issues, trade uncertainty, or job market changes from new technology like artificial intelligence.

|

The Bottom Line? Markets have done well under different Fed Chairs and policies but lower interest rates can create ripple effects. When rates fall, bond prices often rise, stocks may gain from cheaper borrowing costs, and fiat currencies can weaken, boosting exports. For consumers and businesses, lower rates mean more affordable loans and greater spending power, which may fuel growth. |

Large Cap Equity is represented by the S&P 500 Total Return Index is a market-capitalization weighted index of the 500 largest U.S. publicly traded companies. The high yield bonds are represented by the Bloomberg US Corporate High Yield Total Return Index that measures the USD-denominated, high yield, fixed-rate corporate bond market. Investment grade bonds are represented by the Bloomberg US Agg Index that measures the investment grade, US dollar-denominated, fixed rate taxable bond market. 10-year Treasury is represented by the Bloomberg US Treasury Bellwethers 10 Year Index that measures the on-the-run (most recently auctioned) U.S. Treasury bond with 10 years’ maturity. The growth equity is represented by the Russell 1000® Growth Total Return Index that measures the performance of the large-cap growth segment of the US equity universe. The value equity is represented by the Russell 1000® Value Index that measures the performance of the large-cap value segment of the US equity universe. The small cap equity is represented by the Russell 2000 Index, which measures the performance of small-cap segment of the US equity universe.

Carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. This and other information can be found in the Fund’s statutory and summary prospectuses, which may be obtained at AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Exposure to cryptocurrencies, such as bitcoin, is highly speculative and may be subject to extreme volatility and risk of total loss. Investors should be prepared to lose their entire investment. The regulatory and tax treatment of digital assets and cryptocurrencies is uncertain and evolving.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.