Markets & Crypto Update: Volatility in AI, Crypto, and Fed Rate Expectations

Market and Economic Update

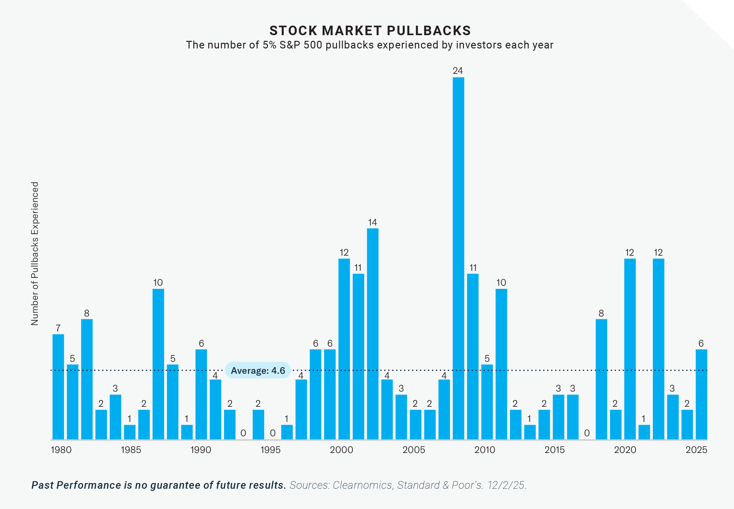

In November, markets saw some ups and downs that affected many types of investments. While major stock and bond indexes have shown strong gains so far this year, investors are worried about three main things: artificial intelligence (AI) stocks, cryptocurrency prices, and future interest rate changes by the Federal Reserve (the Fed). A government shutdown also delayed important economic reports, making it harder to understand how the economy is performing.

Despite these ups and downs, many investments that started off November in the red had recovered by month’s end. This shows why it’s important for long-term investors to stick with their investment plan through good times and bad.

1. What happened in markets and crypto during November

In November, investors temporarily moved away from riskier investments like technology stocks, high-yield bonds, and cryptocurrencies. This happened mainly because of concerns about AI spending and changing expectations for Fed rate cuts. The S&P 500 (a measure of large U.S. stocks) ended the month slightly higher, rising 0.1%. So far this year, it’s up 16.4%.

AI-related technology stocks had their worst week since April. Investors worried about these companies’ spending, debt, and profit levels. However, the underlying business results remained strong. For example, Nvidia reported healthy revenue and earnings growth. Some major tech stocks recovered after releasing these positive reports.

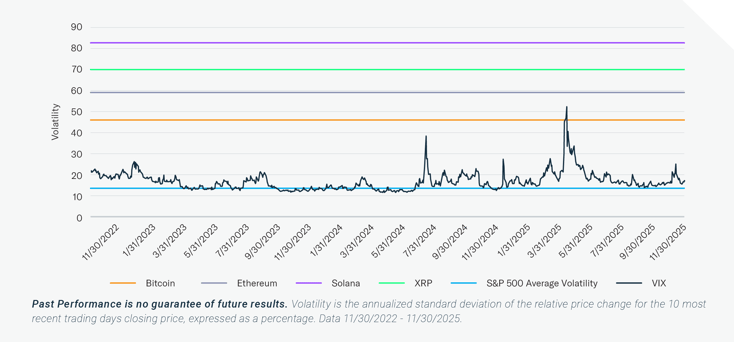

Major Cryptocurrencies such as Bitcoin also fell sharply during this period. Bitcoin dropped over 30% from its early October highs above $125,000, briefly trading below $85,000. This reminds us that cryptocurrencies can be highly volatile and go through cycles, which may have made investors cautious about adding an allocation to their portfolios. In the past 3 years, Bitcoin, Ethereum, Solana, and XRP have historically demonstrated 3-6x more average volatility than the S&P 500.

2. Crypto Average Price Volatility

Periods of heightened volatility often prompt investors to reassess risk management approaches. While some may reduce exposure outright, others explore strategies that aim to smooth returns without fully sacrificing upside. For example, option-based techniques – such as covered calls (especially those with out of the money1 strike prices) – can provide a way to generate income while maintaining participation in potential rebounds. These approaches are not without trade-offs, but they illustrate how volatility can be reframed as an opportunity rather than solely a risk.

The bond market’s steady performance in November, with the Bloomberg U.S. Aggregate Bond Index up 0.6% for the month and 7.5% year-to-date, helped provide balance to diversified portfolios amid equity swings and crypto volatility. This stability is welcome as investors look ahead to policy decisions and economic signals.

3. The government shutdown and economic data

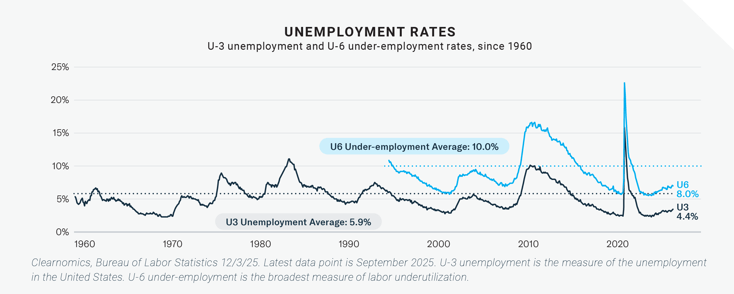

The recent government shutdown, which lasted 43 days, delayed key reports and added uncertainty. While markets largely shrugged off the disruption, the lack of timely data complicates the Federal Reserve’s task. The September jobs report showed 119,000 jobs added and unemployment ticked up to 4.4%, still historically low. With no October report and limited visibility, the Fed will meet in mid-December without a full picture of labor trends.

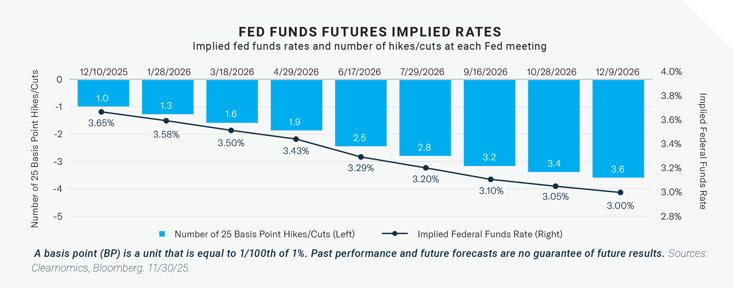

4. What to expect from the Federal Reserve

Current market expectations point toward a rate cut in December and possibly another in spring 2026 as policymakers weigh slowing momentum against persistent inflation concerns. Consumer confidence has softened, reflecting worries about job security and prices, yet spending remains resilient – holiday sales exceeded forecasts, driven by strong online activity and AI-driven search trends.

|

The Bottom Line? November’s mix of equity gains, crypto volatility, and bond strength underscores the importance of staying focused on fundamentals. As the year closes, the Fed’s decisions and economic data may shape early 2026, but for long-term investors, maintaining discipline and perspective remains key. |

1OTM call options seek to balance growth potential with income generation. All indexes are unmanaged and it’s not possible to invest directly in an index. The S&P 500 Total Return Index is a market-capitalization weighted index of the 500 largest U.S. publicly traded companies. CBOE Volatility Index (VIX) is a measure of implied volatility, based on the prices of a basket of S&P 500 Index options with 30 days to expiration. The Bloomberg US Aggregate Bond Index, or the Agg, is a bond market index representing intermediate term investment grade bonds traded in the United States. The Bloomberg Solana index is designed to measure the performance of a Solana token in USD. The Bloomberg XRP Index is designed to measure the performance of an XRP token in USD. The Bloomberg Bitcoin Index is designed to measure the performance of a single bitcoin traded in USD. The Bloomberg Ethereum Index is designed to measure the performance of a single Ether traded in USD

Carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. This and other information can be found in the Fund’s statutory and summary prospectuses, which may be obtained at AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Exposure to cryptocurrencies, such as bitcoin, is highly speculative and may be subject to extreme volatility and risk of total loss. Investors should be prepared to lose their entire investment. The regulatory and tax treatment of digital assets and cryptocurrencies is uncertain and evolving.

Amplify ETFs are distributed by Foreside Fund Services, LLC.

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained by calling 855-267-3837 or by visiting AmplifyETFs.com. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Amplify ETFs are distributed by Foreside Fund Services, LLC.